Self Employed Helpline Coronavirus, Covid 19 Coronavirus Resources

Self employed helpline coronavirus Indeed recently is being hunted by users around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of the post I will discuss about Self Employed Helpline Coronavirus.

- The Business Support Helpline Providing You With Business Advice Under The Coronavirus Outbreak Community Interest Companies

- The Law Society Of Northern Ireland

- Coronavirus Covid 19

- 2

- Coronavirus Covid 19 Support For Businesses Inc Business Rates And Grants Nottingham City Council

- Coronavirus Work Rights Uk Advice For Coronavirus From Unite

Find, Read, And Discover Self Employed Helpline Coronavirus, Such Us:

- Universal Credit How To Claim And How Much You Will Receive Consumer Affairs The Guardian

- Coronavirus Support For Small Businesses The Self Employed

- Coronavirus Covid 19 Support For Businesses Inc Business Rates And Grants Nottingham City Council

- Coronavirus Covid 19

- Help For Artists The Beacon Wantage

If you re searching for Does The Furlough Scheme Cover Holiday Pay you've reached the ideal place. We ve got 100 graphics about does the furlough scheme cover holiday pay including pictures, photos, pictures, backgrounds, and much more. In such web page, we additionally provide number of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Monday to friday 8am to 4pm.

Does the furlough scheme cover holiday pay. Contact hmrc if youre a business or self employed and need help and support with outstanding tax payments due to the coronavirus covid 19. Self assessment vat employers paye corporation tax. Have been affected by coronavirus you wont need to give evidence of this when you apply.

All businesses and self employed people. Be planning to do self employed work in the tax year 2020 21. South belfast covid 19 helpline.

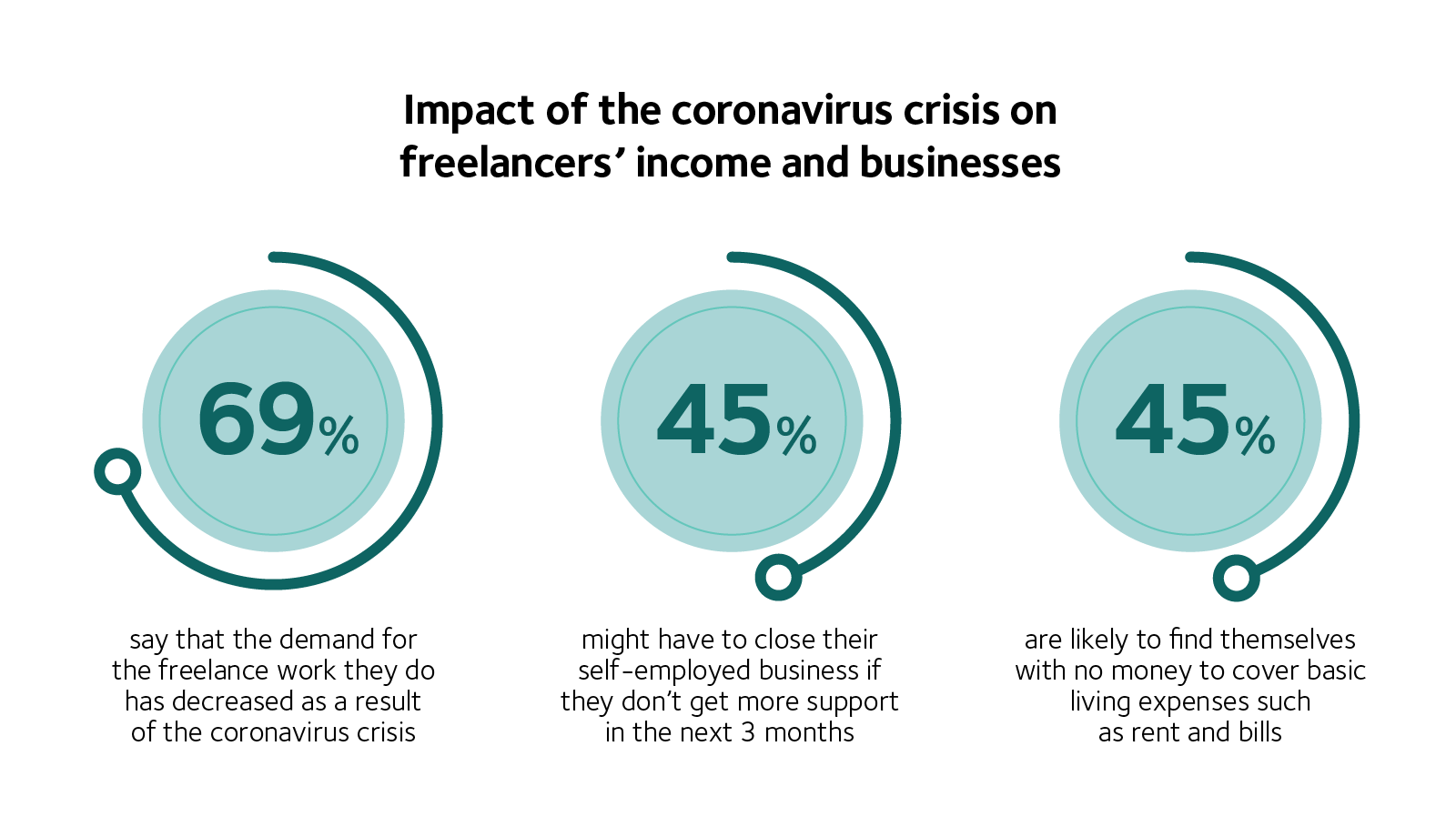

Youll probably also need to have done self employed work in the tax year 2018 19 and submitted your tax return. The coronavirus self employed income support scheme seiss is designed to protect people in a similar way to employed workers although some groups will miss out. Lps small business grant scheme helpline.

The helpline allows any business or self employed individual who is concerned about paying their tax due to coronavirus to get practical help and advice. Hmrc has set up a helpline for businesses and self employed people who are concerned about paying their tax due to covid 19. The self employed are not eligible for the coronavirus job retention scheme which sees the government reimbursing 80 of furloughed workers wage costs up to a monthly ceiling of 2500.

The first grant paid 80 per cent of three months average monthly trading profits over the last three years capped at 7500. Have done self employed work in the tax year 2019 20. Claim a grant if youve lost income.

The self employment income support scheme seiss is made up of a series of grants designed to support self employed people whose business has been adversely affected by coronavirus. Up to 2000 experienced call handlers are. If youre getting less work or no work because of coronavirus covid 19 you might be able to claim a grant through the self employment income support scheme.

However the self employment income support scheme is designed to be an equivalent support measure for this particular category of worker. This includes those who have been ruled out of the uk scheme because they became self employed during the 2019 20 tax year and therefore cannot fulfil the requirement to submit a 2018 19 tax return. Call 08000 241222 for help and advice.

More From Does The Furlough Scheme Cover Holiday Pay

- Government Failure Cartoon

- Us Government Agencies Organizational Chart

- Self Employed Income Tax Calculator Nz

- Government Nursing College Fees In Bangalore

- Job Vacancies Government Gazette 2020

Incoming Search Terms:

- Coronavirus Advice Ni Job Vacancies Government Gazette 2020,

- Coronavirus Your Rights At Work Unison National Job Vacancies Government Gazette 2020,

- Information For Employers Employees And The Self Employed Relating To Covid 19 Donegal Local Development Company Clg Dldc Job Vacancies Government Gazette 2020,

- Coronavirus Covid 19 Helpline For Businesses And Self Employed Gov Uk Job Vacancies Government Gazette 2020,

- Coronavirus Self Employed Income Support Scheme Seiss Crispin Blunt Mp Job Vacancies Government Gazette 2020,

- Coronavirus Help For Businesses And Self Employed Kirklees Council Job Vacancies Government Gazette 2020,