Self Employed Hmrc Tax Return, How To File Tax Return Online In The Uk

Self employed hmrc tax return Indeed recently has been sought by users around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the title of this post I will discuss about Self Employed Hmrc Tax Return.

- Hmrc Glitch Means Self Employed Risk Underpaying Tax Bill Accountancy Age

- I Am A Full Time Employee Do I Still Have To Fill In Self Assessment Tax Return Article Surrey Taxaccolega

- Cashtrak Hmrc Announces Intentions To Stop Automatically Sending Self Assessment Returns

- Hmrc Self Employed Tax Return Paperwork Stock Photo Alamy

- Tax Returns Guide And Calculator For Self Employed Drivers

- Self Assessment Freeagent

Find, Read, And Discover Self Employed Hmrc Tax Return, Such Us:

- Beware Costly Hmrc Websites Ahead Of January 31 Tax Return Deadline This Is Money

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsknc1e5zkgka5c6f Xjc2tsjuzgxvgglv3jx2kshwcfo2nacln Usqp Cau

- Paper Self Assessment Tax Return Deadline

- 2 000 Submitted Tax Returns To Hmrc On Christmas Day In 2019

- How To Get Your Sa302 Form Online Or By Phone Goselfemployed Co

If you are looking for Self Employed Proof Of Income Letter Template you've arrived at the right location. We have 104 images about self employed proof of income letter template including pictures, pictures, photos, wallpapers, and much more. In these web page, we additionally provide number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

End Of Year Accounts Template For Self Employed Small Business No Hassle Accounting Self Employed Proof Of Income Letter Template

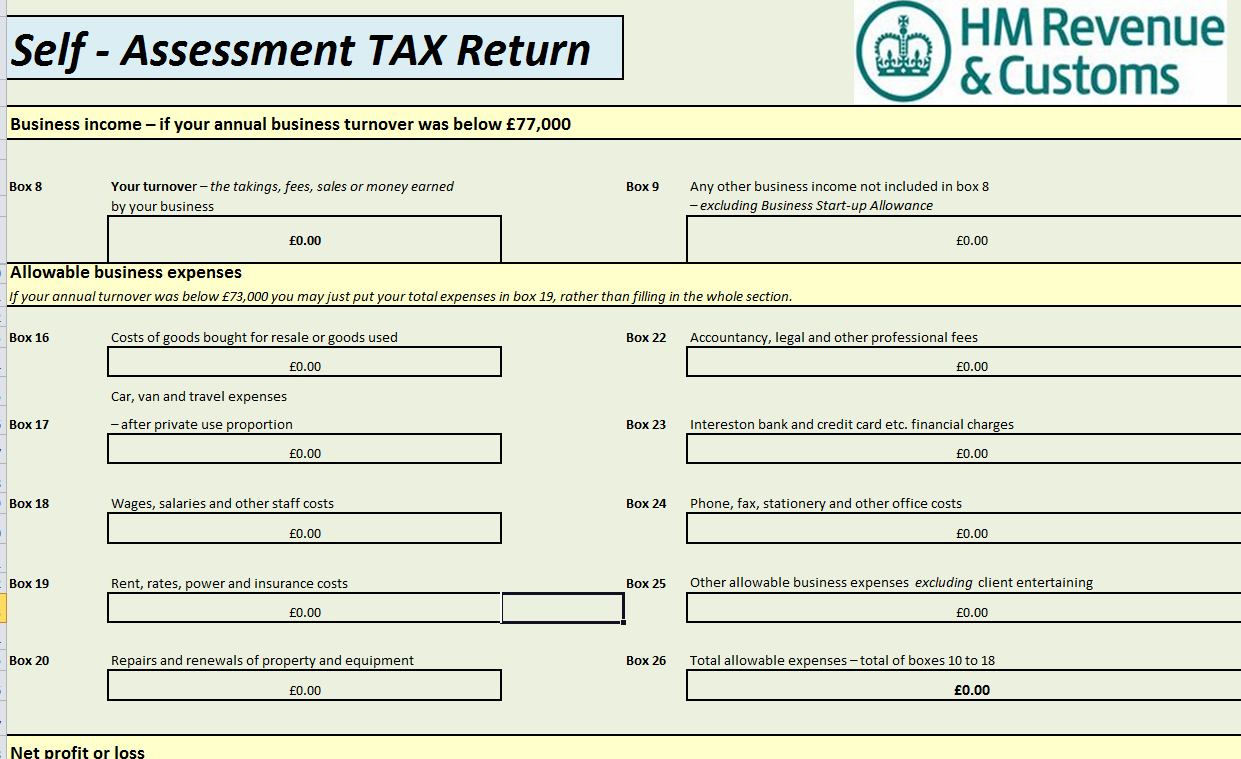

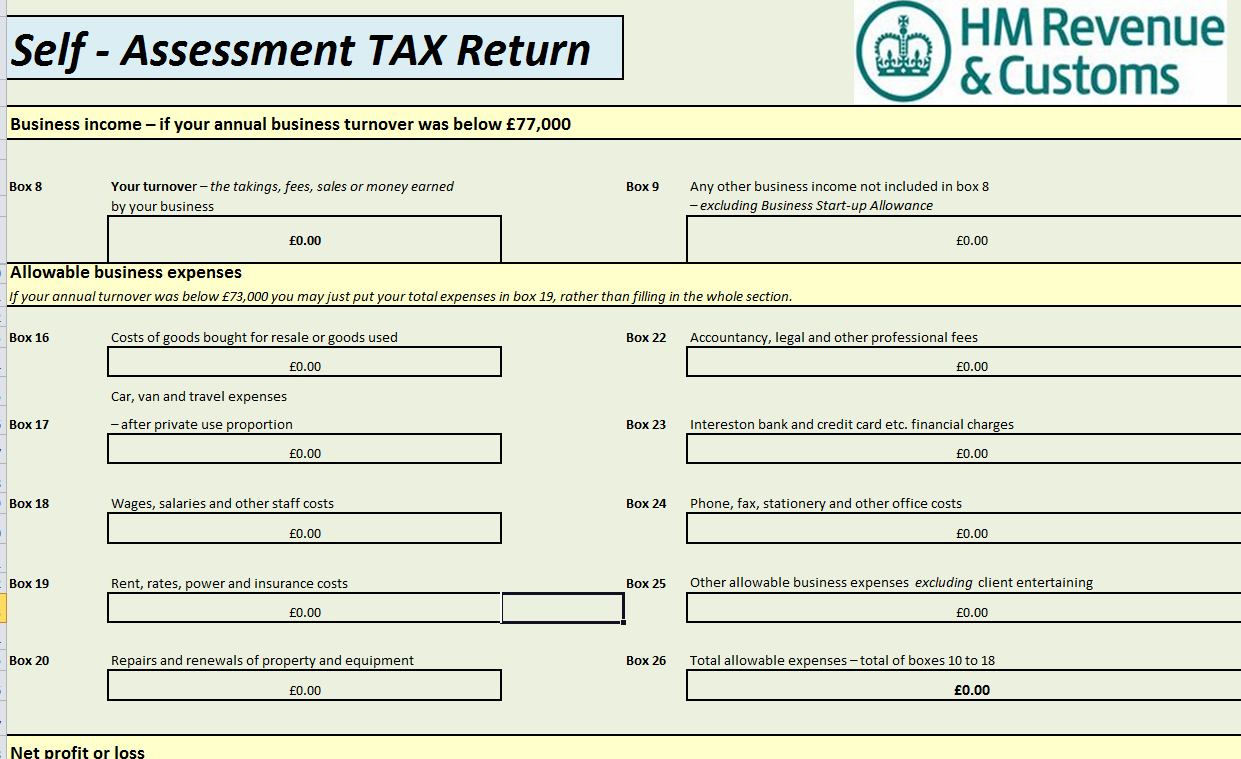

The main section is the sa100 which deals with.

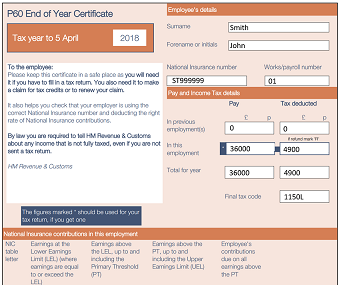

Self employed proof of income letter template. Self assessment is a system hm revenue and customs hmrc uses to collect income taxtax is usually deducted automatically from wages pensions and savings. Self employed or a sole trader. Sign in to hmrc online services once youve registered you can sign in for things like your personal or business tax account self assessment corporation tax paye for employers and vat.

Find out who has to complete a tax return for the 2019 20 tax year and how self assessment works. If you have not told hmrc you need to send a return. This is true whether youre a sole trader are in a business partnership or run a limited company.

How to fill in a self assessment tax return. Send in your completed tax returns documentation or general enquiries to the following address. But due to the fallout of coronavirus if you have tax payments due in july 2020 under the self assessment system you can defer them until january 2021.

Register if youre self employed if you have to send a tax return and did not send one last year you need to register for self assessment and class 2 national insurance. The hmrc self assessment process can seem complicated at first especially as the government often likes making changes to self employed tax. Register by 5 october in.

The self employment short form and notes have been added for tax year 2018 to 2019. Self assessment hm revenue and customs bx9 1as. If youre self employed youll need to fill in a self assessment tax return each year and pay your tax bill either in one go by 31 january or using payment on account.

There are different ways to register for self assessment if youre. Registering a partner. Self assessment tax returns must be submitted each year by self employed people but also those with many other types of income.

Taxed and untaxed income in the form of dividends and interest. There are two sections to a self assessment tax return. This is the postal address for tax return general enquiries and can be used for anything except self assessment complaints correspondence for that should be done to the address further down the page.

People and businesses with other income.

More From Self Employed Proof Of Income Letter Template

- Local Government Lgu Organizational Chart

- Us Government Accountability Office Staff Directory

- Self Employed Kitchen Fitter

- Self Employed Universal Credit Forum

- Government Building Cartoon Png

Incoming Search Terms:

- Free Download Our Self Employment Guide The Low Incomes Tax Reform Group Government Building Cartoon Png,

- How To Claim Self Employed Grant Who Can Apply For Second Hmrc Payment And How Seiss Works Government Building Cartoon Png,

- 12 Things To Know About Your Self Employed Tax Return For 2017 18 Which News Government Building Cartoon Png,

- Reporting Income Tax For The Self Employed By Grafton Jones Issuu Government Building Cartoon Png,

- Hmrc Self Employed Tax Return Paperwork Stock Photo Alamy Government Building Cartoon Png,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcs6tprup89lkckrro Kqxjgwls7ax7b Yevys5os7kx4e638iam Usqp Cau Government Building Cartoon Png,