Self Employed Pension Tax Relief Calculator, 60 Tax Relief On Pension Contributions Royal London For Advisers

Self employed pension tax relief calculator Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the name of this article I will talk about about Self Employed Pension Tax Relief Calculator.

- Pension Tax Relief Rishi Sunak Refuses To Change Rules What Will Hmrc Do Going Forward Personal Finance Finance Express Co Uk

- Self Administered Pensions Qmoney

- Income Tax For Self Employed Or Businessman Laws Rates And Filing

- Taxes Pensions And Health Insurance Gaijinpot

- How Do I Calculate Tax Credits Low Incomes Tax Reform Group

- Income Tax Calculator On Employed And Self Employed Income Taxscouts

Find, Read, And Discover Self Employed Pension Tax Relief Calculator, Such Us:

- How Do I Pay Tax On Self Employed Income Low Incomes Tax Reform Group

- Not Fit For Purpose Tax Glitch Putting Pensions Of Self Employed At Risk Money The Guardian

- Taxtips Ca 2020 And 2019 Canadian Income Tax And Rrsp Savings Calculator

- Pension Tax Relief Calculator 2020 21 Drewberry

- Amazon Com Uk Tax Calculators Appstore For Android

If you re searching for Government Accounting Manual Volume Ii you've reached the ideal location. We ve got 100 graphics about government accounting manual volume ii including images, photos, photographs, wallpapers, and much more. In such webpage, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

If youre a higher rate taxpayer you can submit a tax return and claim the rest another 20.

Government accounting manual volume ii. This calculator has been updated for the 2020 21 tax year. It means that your contributions are taken from your net pay after your wages are taxed. This also has its drawbacks.

For example an employee who is aged 42 and earns 40000 can get tax relief on annual pension contributions up to 10000. The maximum amount of earnings taken into account for calculating tax relief is 115000 per year. Before or after income tax and if tax relief has to be claimed back from hmrc.

Employer prsa contributions are. Deemed for tax relief purposes to be made by the employee. To do this enter your self employed pension contributions into the section of your tax return labelled tax reliefs.

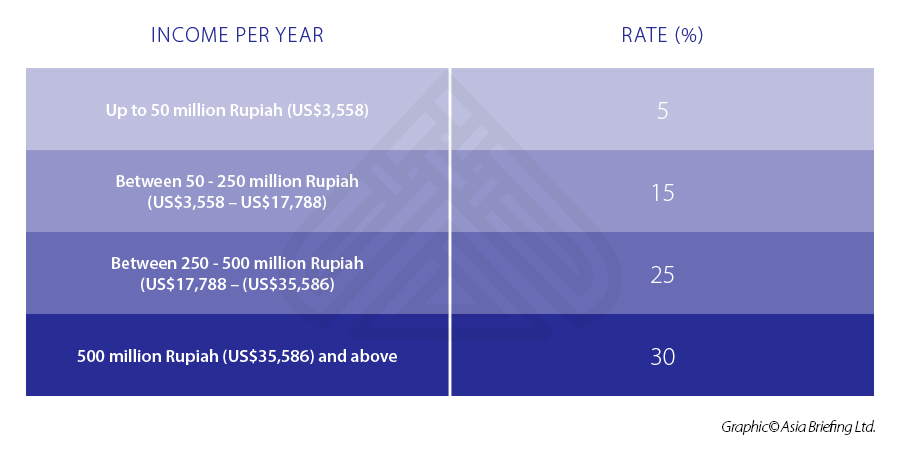

1 up to the amount of any income you have paid 21 tax on. Tax relief on your contributions is normally limited to 100 of your earnings. Why its important to plan ahead.

This effectively means you have to pay less in net to get your total gross contribution. Then your pension provider automatically claims tax relief for you from hmrc adding the basic tax rate of 20 to your pension contributions. In summary if you are self employed and making personal pension contributions you will usually get 20 tax relief in the form of this being added to your pension by the government and in addition to this you will get income tax relief through your personal tax return if your earnings are above the basic tax band.

To use this calculator simply add your annual income and how much you are paying into your pension. These figures may not equal your gross annual salary as it depends on when your pension contributions are taken ie. Even if you dont have any earnings you can still pay up to.

Summary of self employed pension tax relief. 21 up to the amount. For example employees particularly within large organisations have a network they can fall back on for all their income related queries such as pension planning.

Well break down exactly how much tax relief will be added. 20 40 and 45 tax relief is available on contributions. The great thing about being self employed is the freedom to be your own boss.

Pension tax relief is one of the most valuable benefits youll ever get from the governmentwhen you save into a pension you get tax relief on pension contributions from hmrc at your highest marginal rate depending on which income tax bracket you fall into.

More From Government Accounting Manual Volume Ii

- Self Employed Eidl Loan

- Federal Government Spending 2019

- Central Government Loans For Msme

- Government Furlough Scheme July

- What Date Is Furlough Extended To

Incoming Search Terms:

- Contractor Tax Calculator Spreadsheet In 2020 Tax Deductions Business Tax Deductions Deduction What Date Is Furlough Extended To,

- Tax Relief On Pension Contributions Explained Which What Date Is Furlough Extended To,

- 2 What Date Is Furlough Extended To,

- Lowquotes Author At Lowquotes What Date Is Furlough Extended To,

- Canadian Tax Brackets Marginal Tax Vs Average Tax Retire Happy What Date Is Furlough Extended To,

- Amazon Com Uk Tax Calculators Appstore For Android What Date Is Furlough Extended To,