Self Employed Sss Contribution Table 2020, Sss Contribution Table 2018 How Is It Different From The New One Para Sa Pinoy

Self employed sss contribution table 2020 Indeed lately is being sought by consumers around us, perhaps one of you. People now are accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the name of this post I will discuss about Self Employed Sss Contribution Table 2020.

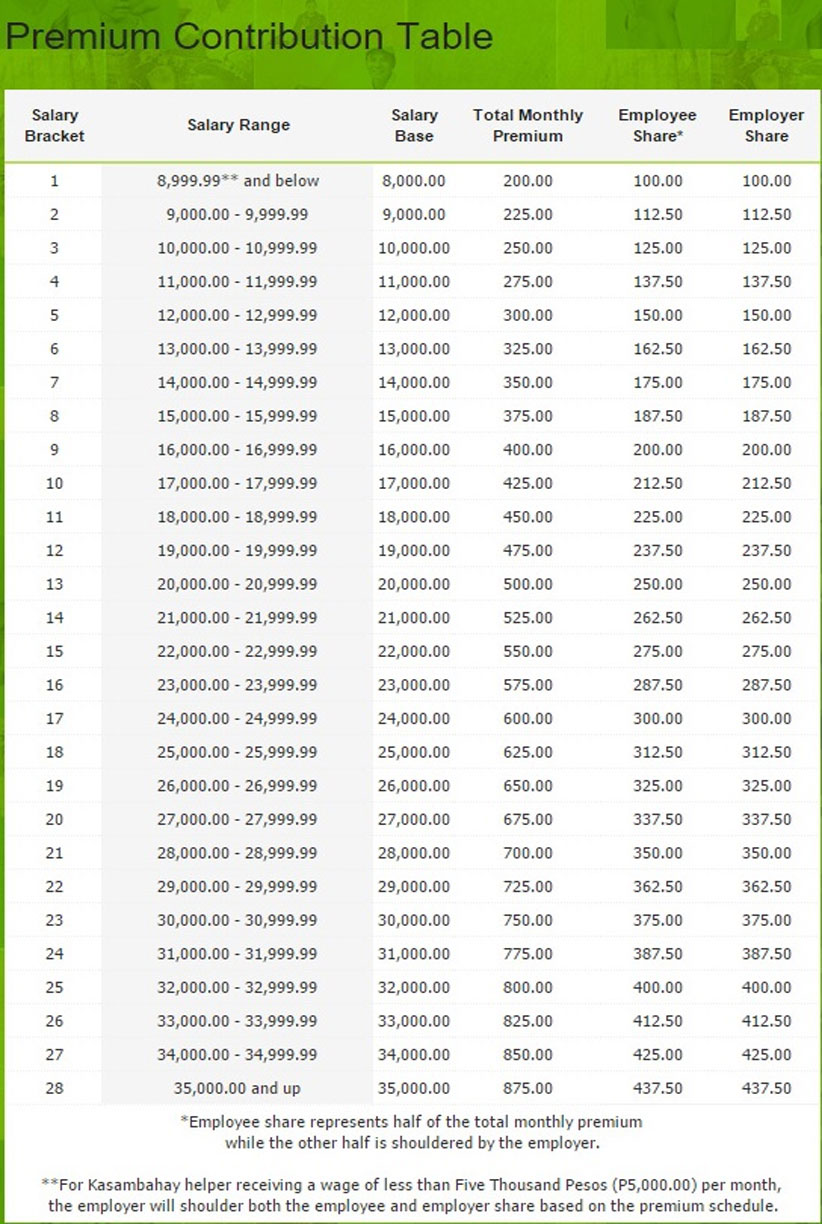

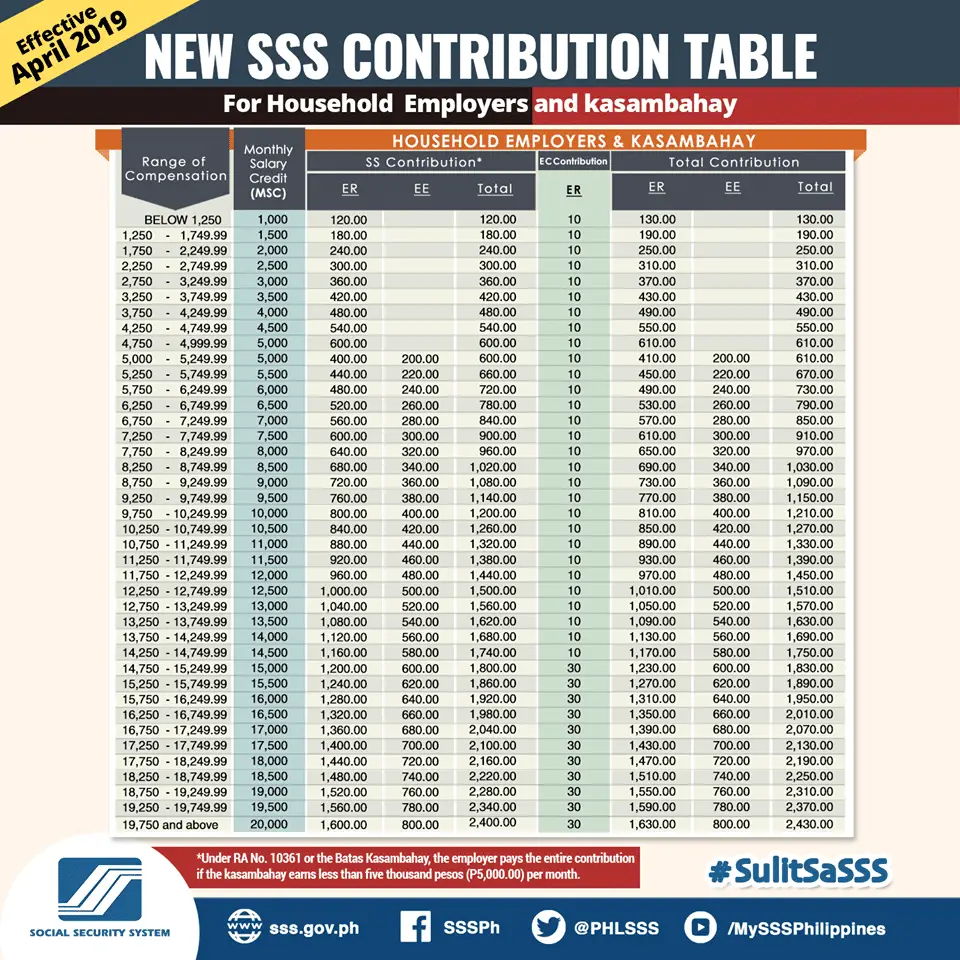

- New Sss Contribution Table 2019 Effective April 2019

- New Philhealth Contribution Table For 2017 Ph Juander

- Sss Contribution Table 2018 Voluntary Self Employed Ofw Members Sss Answers

- Updated Sss Contribution Table And Schedule Of Payment For 2019 Sss Guides

- New Philhealth Contribution Table 2020

- How To Pay Sss Contributions And Where To Make Your Sss Payments The Pinay Investor

Find, Read, And Discover Self Employed Sss Contribution Table 2020, Such Us:

- New Sss Contribution Table 2019 Bigger And Better Benefits

- Sss Online Registration And Steps To Check Sss Your Contribution Online

- The New Sss Contribution Table For 2016 Cebu Gems Innovation And Career Development Center Inc Facebook

- Philippine Social Security System Contribution Table 2016 Auxbreak Com

- Updated Sss Contribution Table And Schedule Of Payment For 2019 Sss Guides

If you re searching for Government University In Delhi For Btech you've arrived at the right location. We have 104 graphics about government university in delhi for btech including images, pictures, photos, wallpapers, and much more. In these page, we additionally provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Philhealth Contribution Table For 2020 Philippines Tech News Reviews And Tutorials Blog Government University In Delhi For Btech

How much should voluntary members contribute.

Government university in delhi for btech. For your sss contributions until march 2019 you may refer to the old sss contribution table 2018 below. This news affects you be in the know. The sss governing board has approved contribution increase for its members.

Sss contribution table 2020 for self employed voluntary member and non working spouse. Old sss contribution table 2018. There are basically two types of sss members employees and self employed voluntary member or overseas filipino worker sevmofw.

Not only the sss contribution rate will increase but also. Minimum monthly salary credit is p200000. Non working spouses contribution is half 50 of the their working spouses most recent monthly salary credit with a minimum credit p2000.

Are you a member of sss. The sss contribution table for 2020 is located below specifically created for those who are self employed voluntary or are overseas filipino workers. If you want to download the sss contributions table 2020 then you may double click this image and save on your phone for your handy reference here is the new sss contributions table for employed self employed voluntary and non working spouse sss members for ofw members.

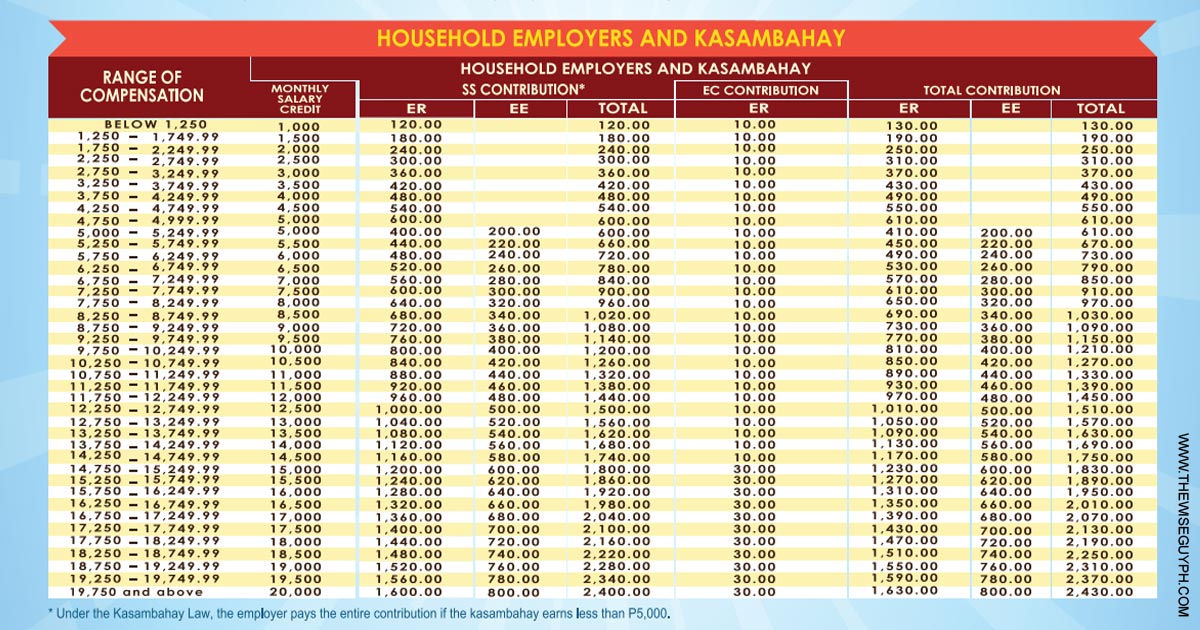

The employer pays 8 while the employee pays 4. Lets say your msc is php 20000 and the contribution rate is 12 for 2019 to 2020 heres how to compute your contribution as a self employed member. For employed members the minimum monthly salary credit is php 2000 with a total contribution of php 250 while the maximum monthly salary credit is php 20000 with a total contribution of php 2430.

Effective april 2019 below is the new sss contribution table for employed self employed voluntary members and non working spouses. The contribution of the non working spouse shall be based on 50 of the monthly salary credit msc of hisher working spouse. For comments concerns and inquiries contact.

For voluntary self employed non working spouse and ofw members. Employed members are required to pay 12 of their monthly salary credit msc not exceeding p20000. 2020 sss contribution table for self employed voluntary or overseas filipino workers the contribution rate for overseas filipino workers ofws earning less than p8250 monthly is p960 and p2400 for those with more than p19750 monthly.

Its tricky to determine the sss contribution of voluntary members because their income is not fixed. The social security system or sss which oversees the pension plan for the private sector will impose a higher contribution rate for its members from the existing 11 to 12 effective april 1 2019. The sss contribution table guides you on the amount that you should pay as a member of the sss.

More From Government University In Delhi For Btech

- Government Shutdown History Chart By President

- Government Jobs Names List

- Who Pays Scotlands Furlough Bill

- What Is Furlough Military

- French Government Building Cartoon

Incoming Search Terms:

- Philippines Mandatory Employee Benefits Contributions French Government Building Cartoon,

- Allcare French Government Building Cartoon,

- How To Compute Sss Philhealth And Hdmf Pag Ibig Contributions Anything On The Web French Government Building Cartoon,

- New Sss Contribution Table 2019 Bigger And Better Benefits French Government Building Cartoon,

- New Sss Contribution Table 2014 Raincheck French Government Building Cartoon,

- Sss Contributions Table And Payment Deadline 2020 Sss Inquiries French Government Building Cartoon,