Self Employed Vat Rate, Bookkeeping Spreadsheets For Vat And Non Vat Now Mtd Ready Mr Spreadsheet

Self employed vat rate Indeed lately is being hunted by consumers around us, perhaps one of you. Individuals are now accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the name of this post I will discuss about Self Employed Vat Rate.

- A Contractors Guide To Vat Guides

- The Self Employed Earnings Crash Flip Chart Fairy Tales

- Self Employed Small Business Sales Accounting Spreadsheets

- Treasury Cut Taxes To Reduce Ppe Costs Gov Uk

- 2019 20 Tax Rates And Allowances Boox

- 2019 20 Tax Rates And Allowances Boox

Find, Read, And Discover Self Employed Vat Rate, Such Us:

- Income Tax For Self Employed Professionals Infographic Cloudcfo

- Tax Revenues Where Does The Money Come From And What Are The Next Government S Challenges Institute For Fiscal Studies Ifs

- Self Employed To Limited Company Sjd Accountancy

- Are You In Low Paid Self Employment And Considering Becoming Vat Registered Low Incomes Tax Reform Group

- D V Philippines Infographic Understanding The Train Law

If you are looking for Self Employed Help From Covid you've arrived at the right location. We ve got 104 graphics about self employed help from covid adding pictures, photos, pictures, backgrounds, and more. In such webpage, we additionally have variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Make sure you check with your accountant to work out how these changes could affect you.

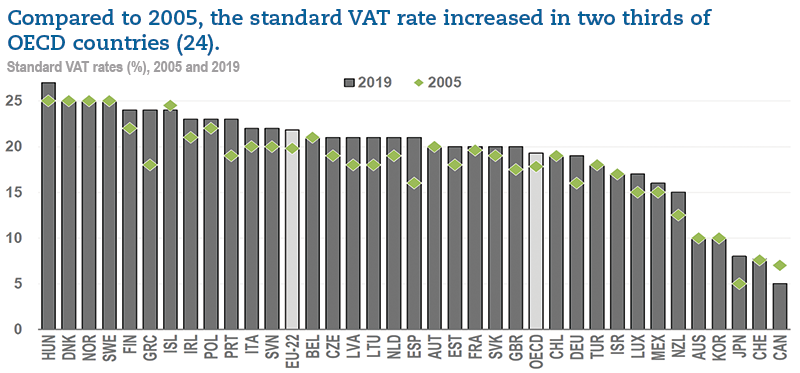

Self employed help from covid. This means that self employed people pay a total of 11 usc on any income over 100000. There are three main rates standard rate 20 reduced rate 5 and zero rate 0. The standard rate of vat is 20.

Equally depending on what you buy in your business you may pay different rates of vat. Universal social charge prsi and vat. Vat in spain for self employed people freelance tax in spain extends to the impuesto sobre el valor anadido iva or vat.

Changes to vat in 2010. Everyone is liable to pay the universal social charge usc if their gross income is over 13000 in a year. There are also low rates for flat rate farmers.

Make sure that any invoices you raise after this date have the new vat rate added. From january 1st the standard vat rate will change from 15 to 20. Find out more about registering for vat and how much you should be charging your clients.

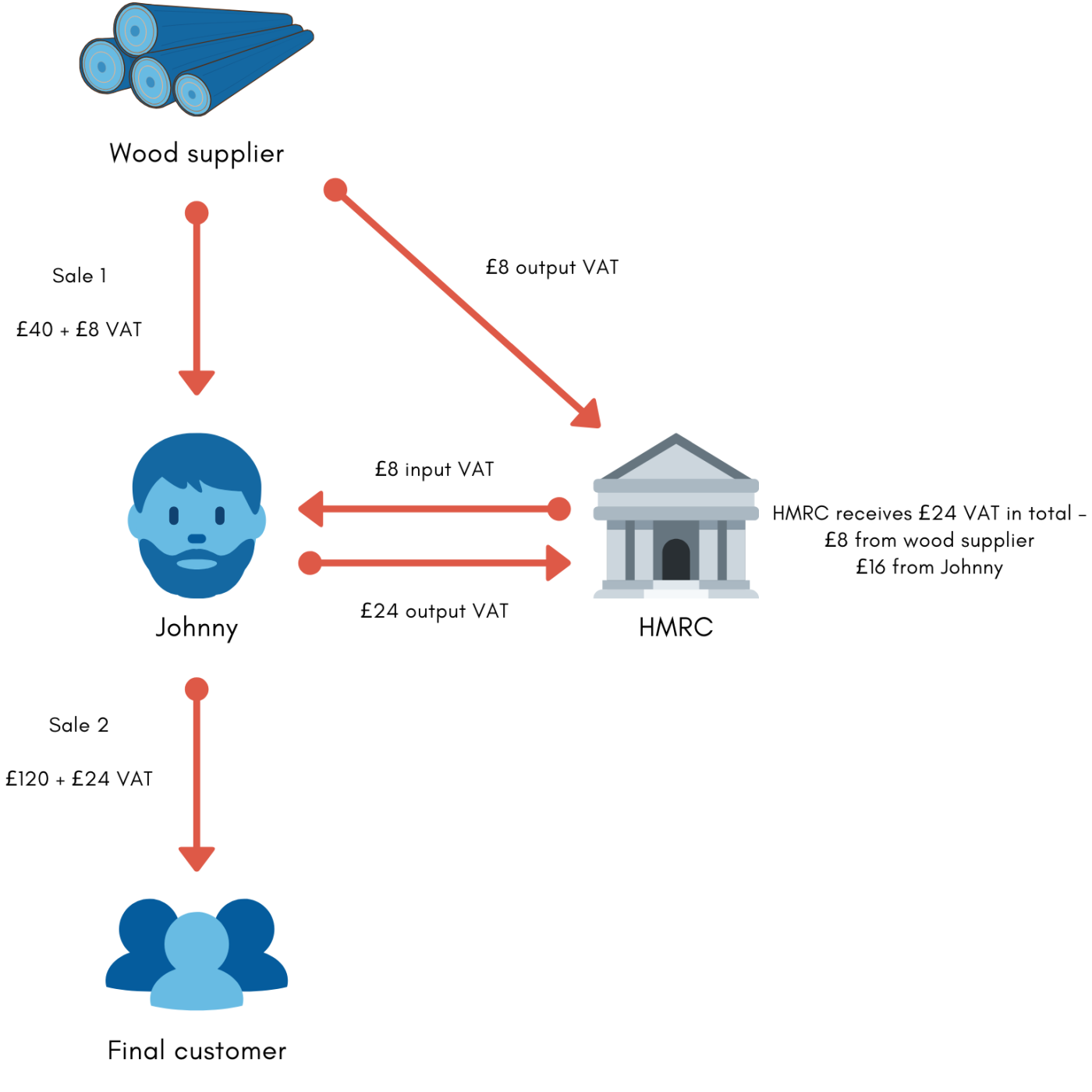

Certain items are charged at lower rates for example childrens clothing is charged at the rate of 0 whereas household fuel for example gas and electricity is charged at the reduced rate of 5. The vat is charged at 21 or 9 depending on the type of product or service. Vat rates for self employed people.

There are plenty of changes to be aware of in 2010. For other products and services you will pay the general high vat rate of. Like other businesses freelancers must pay 21 irrespective of annual turnover although some goods and services such as educational services artistic endeavors and some forms of independent writing are exempt.

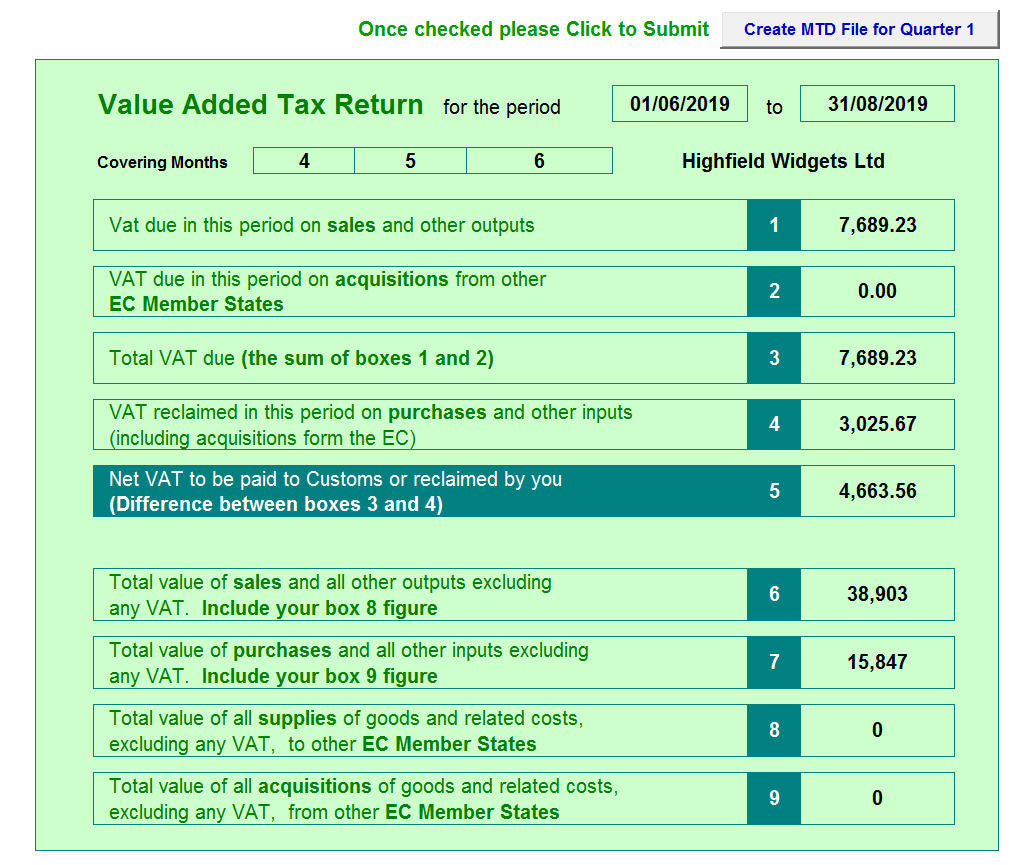

Self employment is a great way to branch out of your comfort zone and apply something youre passionate about. The 9 tariff the low tariff is applied to many common products or services such as food and drink medicines books online publications and magazines. If your self employed business profits exceed the vat threshold youll have to register for vat and regularly make a vat return.

A good understanding of vat is vital for freelancers or the self employed. Advantages of being self employed. This guide explains what the vat threshold is what the pros and cons are of voluntarily registering for vat.

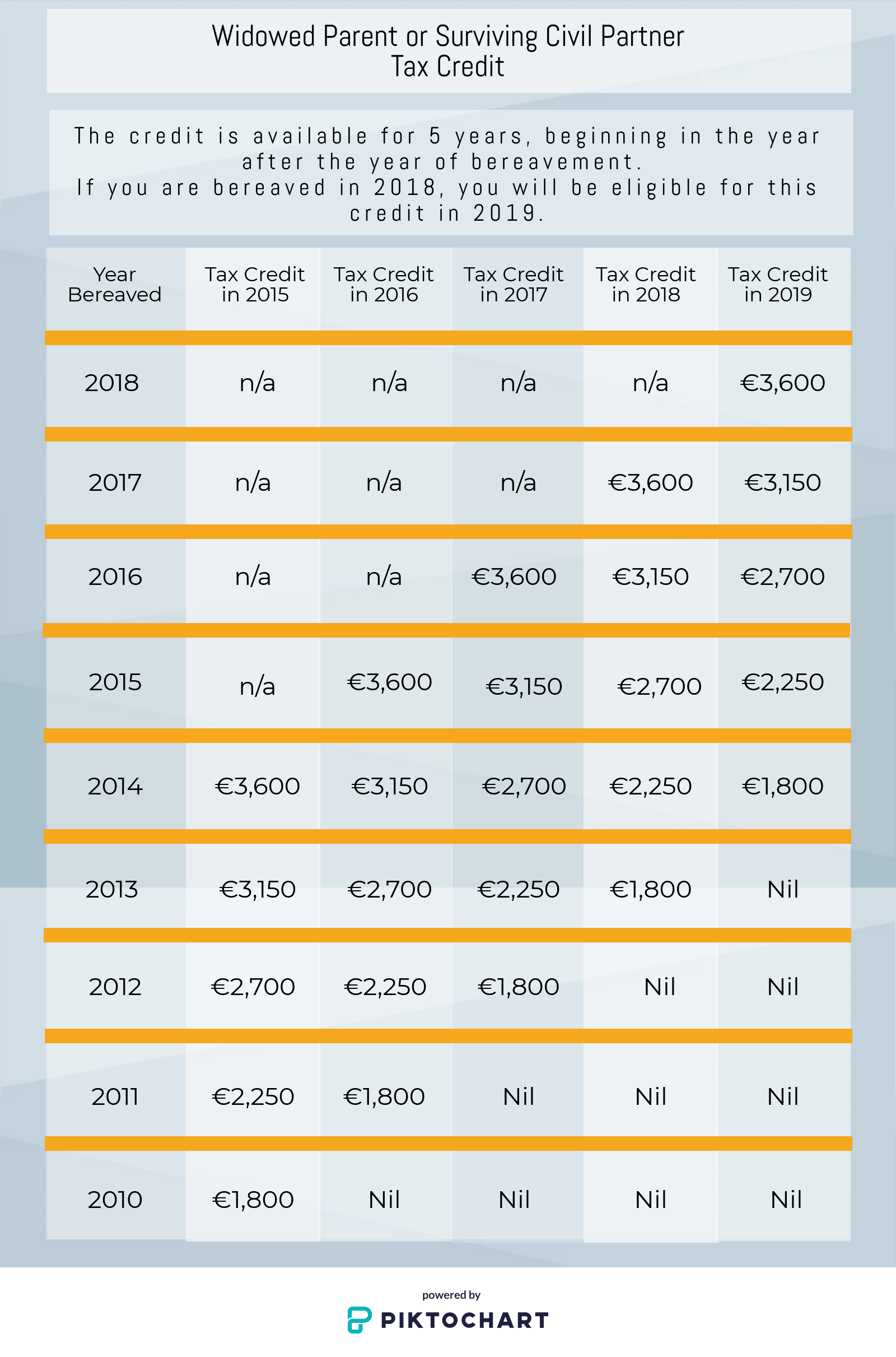

Then there are married rates and parent rates which can affect tax increases or decreases. Below is a table which includes a brief summary of the main vat schemes that self employed businesses choose. An extra charge of 3 applies to any self employed income over 100000 regardless of age.

Vat change from 15 to 20. The rates of vat are the standard rate 23 or reduced rates 9 and 135 and zero rated 0.

More From Self Employed Help From Covid

- Government Contractor Logo

- Lenovo B490 Government Laptop Display Price

- Government Policy Maker

- Government Of India Act 1919 Upsc Notes

- Government To Citizen Services

Incoming Search Terms:

- Qlf9qt6kmkkq0m Government To Citizen Services,

- Shifting Taxes From Labor To Consumption More Employment And More Inequality Pestel 2017 Review Of Income And Wealth Wiley Online Library Government To Citizen Services,

- Filing 8 Income Tax T Ask Ation Government To Citizen Services,

- The Self Employed Earnings Crash Flip Chart Fairy Tales Government To Citizen Services,

- Managing Vat As A Self Employed Made Easy Accountable Government To Citizen Services,

- Treasury Cut Taxes To Reduce Ppe Costs Gov Uk Government To Citizen Services,