Self Employed Wage Subsidy Form, Trudeau Unveils 82b Covid 19 Emergency Response Package For Canadians Businesses Cbc News

Self employed wage subsidy form Indeed lately has been hunted by consumers around us, maybe one of you. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of the post I will talk about about Self Employed Wage Subsidy Form.

- Faq On The Wage Subsidy Programme Donovan Ho

- Http Www Ilo Org Wcmsp5 Groups Public Ed Dialogue Act Emp Documents Publication Wcms 754728 Pdf

- Job Retention Schemes During The Covid 19 Lockdown And Beyond

- Wage Subsidy And Leave Support Complaints About Employers Employment New Zealand

- Http Documents Worldbank Org Curated En 383541588017733025 Pdf Social Protection And Jobs Responses To Covid 19 A Real Time Review Of Country Measures April 24 2020 Pdf

- Distributional Risks Associated With Non Standard Work Stylised Facts And Policy Considerations

Find, Read, And Discover Self Employed Wage Subsidy Form, Such Us:

- Trudeau Unveils 82b Covid 19 Emergency Response Package For Canadians Businesses Cbc News

- Ckl Small Businesses Sole Proprietors And Self Employed Your Cheat Sheet For Your Eligibility For Government Support The New Cerb Wage Subsidies And 40 000 Line Of Credit

- 2

- 1 500 A Fortnight Jobkeeper Wage Subsidy In Massive 130 Billion Program

- Distributional Risks Associated With Non Standard Work Stylised Facts And Policy Considerations

If you re looking for Government Vacation Rewards Cancellation you've come to the perfect location. We ve got 100 images about government vacation rewards cancellation including images, photos, photographs, wallpapers, and more. In such webpage, we also have variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Job Retention Schemes During The Covid 19 Lockdown And Beyond Government Vacation Rewards Cancellation

Many self employed people will receive the wage subsidy in the 2020 tax year but in most cases only 1 or 2 weeks of it relates to the 2020 tax year.

Government vacation rewards cancellation. Eligible employers and seps may submit online application from may 25 to june 14. Applications for the wage subsidy extension closed on 1 september 2020. In their case however the subsidy is 75 of the actual amount of salary paid after march 15 rather than what it was prior to march 15.

You meet the eligibility criteria for the wage subsidy subsidy. The coronavirus self employed income support scheme seiss is designed to protect people in a similar way to employed workers although some groups will miss out. An 8 week wage subsidy extension payment was available nationally for employers including self employed people who were significantly affected by covid 19 after the original wage subsidy scheme closed in june 2020.

Self employment declaration is significant for income tax purposes because there is an expectation of profit and evidence to support the existence and continuity of an enterprise. You must meet the eligibility criteria. Posted by 6 months ago.

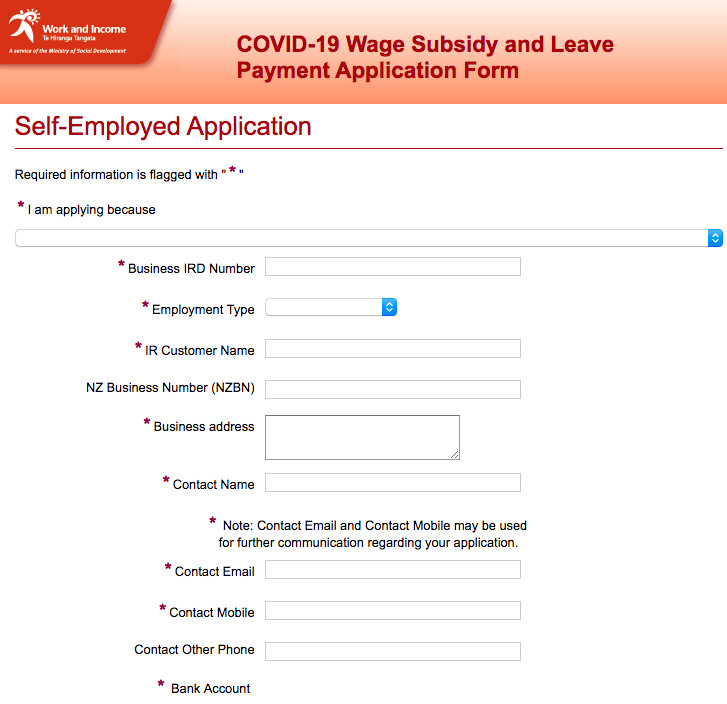

Application for the first tranche of wage subsidy under the ess can be made starting from may 25. In addition to the canada emergency wage subsidy the employer will also. By submitting this form you are declaring that.

Overall declaring yourself as a self employed person means stating exactly everything you deal in even if it is an activity that does not earn your business any profit. My gf is self employed with a corporation she has a small business with 1 other worker does the wage subsidy apply to her and her worker. Based on my personal experience though i do believe that there are some mistakes that self employed individuals may possibly make in applying for their wage subsidy.

In accordance with item 5 of paragraph 1 of article 17 of the law on personal income tax the subsidy granted by the employment service to self employed persons shall be considered as non taxable income and the subsidy to persons with individual activity certificates shall be considered as non taxable income too. Does the 75 wage subsidy apply to self employed people. You operate a business being a registered business sole trader self employed person registered charity 1 incorporated society 2 non government organisation or post settlement governance entity in new zealand that employs and pays.

There is an issue about whether the wage subsidy received by a self employed person is taxable in the year it is received or spread over the 12 week period. Does the 75 wage subsidy apply to self employed people.

More From Government Vacation Rewards Cancellation

- Sri Lanka Government Gazette 2020 September 11 Sinhala Tamil English

- Printable Self Employed Check Stubs Template

- Government Veterinary Hospital Hebbal

- Clipart Republic Government Symbol

- Is The Furlough Scheme Going To Be Extended Past October

Incoming Search Terms:

- For Employers Employees And Self Employed Local Enterprise Office Is The Furlough Scheme Going To Be Extended Past October,

- Job Seeker To Job Keeper Australia S Wage Subsidy Pagetitlesuffix Is The Furlough Scheme Going To Be Extended Past October,

- Temporary Wage Subsidy Self Identification Form Bateman Mackay Is The Furlough Scheme Going To Be Extended Past October,

- Job Retention Schemes During The Covid 19 Lockdown And Beyond Is The Furlough Scheme Going To Be Extended Past October,

- Http Documents Worldbank Org Curated En 383541588017733025 Pdf Social Protection And Jobs Responses To Covid 19 A Real Time Review Of Country Measures April 24 2020 Pdf Is The Furlough Scheme Going To Be Extended Past October,

- Http Www Ilo Org Wcmsp5 Groups Public Ed Dialogue Act Emp Documents Publication Wcms 754728 Pdf Is The Furlough Scheme Going To Be Extended Past October,