Self Employed Wage Subsidy, Covid 19 Update Canada Emergency Wage Subsidy Program Fbc

Self employed wage subsidy Indeed lately has been sought by users around us, perhaps one of you. People now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the title of this post I will talk about about Self Employed Wage Subsidy.

- Covid 19 Update Canada Emergency Wage Subsidy Program Fbc

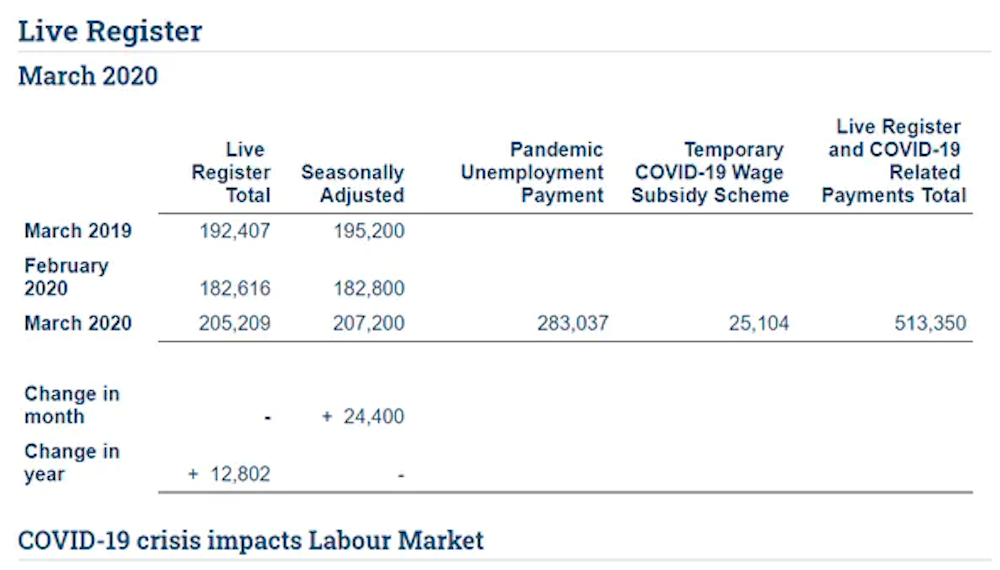

- Job Retention Schemes During The Covid 19 Lockdown And Beyond

- Http Www Ilo Org Wcmsp5 Groups Public Ed Dialogue Act Emp Documents Publication Wcms 754728 Pdf

- Blog Agbiz Accountants

- Wage Subsidies Department Of Jobs And Small Business

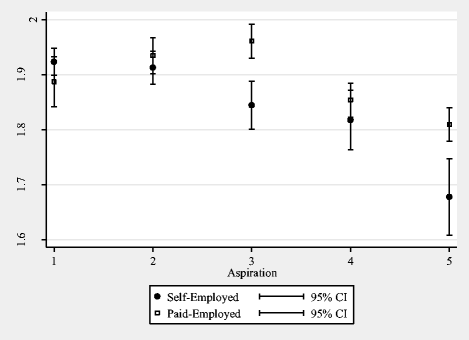

- Issue Note 4 Distributional Risks Associated With Non Standard Work Stylised Facts And Policy Considerations Oecd Economic Outlook Volume 2020 Issue 1 Oecd Ilibrary

Find, Read, And Discover Self Employed Wage Subsidy, Such Us:

- Covid 19 Wage Subsidy Process Baker Tilly Staples Rodway

- Covid 19 Resurgence Wage Subsidy What You Need To Know Tauranga Chamber Of Commerce

- Https Www Revenue Ie En Employing People Documents Pmod Topics Guidance On Operation Of Temporary Covid Wage Subsidy Scheme Pdf

- Issue Note 4 Distributional Risks Associated With Non Standard Work Stylised Facts And Policy Considerations Oecd Economic Outlook Volume 2020 Issue 1 Oecd Ilibrary

- Summary Of The Wage Subsidy Scheme And Essential Workers Leave Support Scheme 7 April

If you are looking for Self Employed Mortgage Broker Earnings you've arrived at the right location. We have 100 graphics about self employed mortgage broker earnings adding pictures, photos, photographs, backgrounds, and more. In these webpage, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

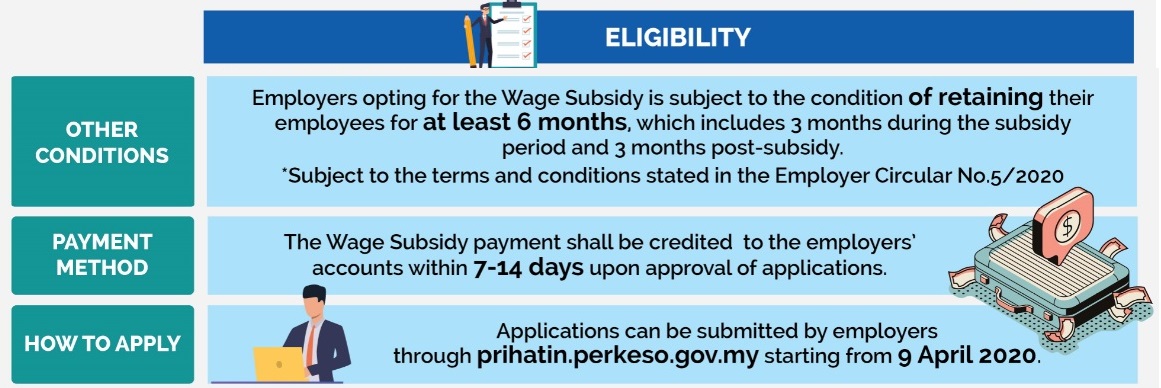

Further information on employment wage subsidy scheme ewss is available from the employing people section on this website.

Self employed mortgage broker earnings. Employers and sole traders could apply for the wage subsidy before 10 june 2020. From a tax perspective the wage and leave subsidy are not subject to income tax or gst how do i code this to ensure i do not pay gst or income tax in error. Is it possible to receive unemployment benefit and a subsidy of 257 eur for a self employed person.

Does this result in different accounting coding. In their case however the subsidy is 75 of the actual amount of salary paid after march 15 rather than what it was prior to march 15. It was to support them if they were impacted by covid 19 and faced laying off staff or reducing hours.

Applications for the wage subsidy extension closed on 1 september 2020. Many self employed people will receive the wage subsidy in the 2020 tax year but in most cases only 1 or 2 weeks of it relates to the 2020 tax year. While the receipt of the wage subsidy is exempt income to an employer if the recipient of the wage subsidy is a self employed person then this should be treated as a payment for loss of income and this amount should be included as taxable income in the relevant tax return.

Business owners could be shareholder employees or self employed. An 8 week wage subsidy extension payment was available nationally for employers including self employed people who were significantly affected by covid 19 after the original wage subsidy scheme closed in june 2020. The ewss will replace the temporary wage subsidy scheme twss from 1 september 2020.

There is an issue about whether the wage subsidy received by a self employed person is taxable in the year it is received or spread over the 12 week period. This subsidy does not affect the unemployment social security benefit so a person can receive both unemployment social insurance benefit and self employed subsidy. The government announced the employment wage subsidy scheme ewss on 23 july 2020.

Temporary covid 19 wage subsidy scheme. The benefit for a self employed person will not be included in the insured income. In addition to the canada emergency wage subsidy the employer will also.

More From Self Employed Mortgage Broker Earnings

- Google What Does Furlough Mean

- Furlough Extension Latest News

- Furlough Retention Scheme Extension

- Government Of India Act 1935 Upsc Questions

- Government Help To Buy

Incoming Search Terms:

- What You Need To Know About The New Covid 19 Emergency Wage Subsidy Cbc News Government Help To Buy,

- Ckl Small Businesses Sole Proprietors And Self Employed Your Cheat Sheet For Your Eligibility For Government Support The New Cerb Wage Subsidies And 40 000 Line Of Credit Government Help To Buy,

- Job Retention Schemes During The Covid 19 Lockdown And Beyond Government Help To Buy,

- Using Rules As Code During Covid 19 Observatory Of Public Sector Innovation Observatory Of Public Sector Innovation Government Help To Buy,

- Credit Strategy Credit Risk News Covid 19 Support For Self Employed Proving Problematic Government Help To Buy,

- Covid And Self Employed In Canada Those Who Also Had T4 Earnings Before The Pandemic Are In A Better Position Job Market Monitor Government Help To Buy,

/Articles/Accounting-Treatment-of-the-Wage-Subsidy-%E2%80%93-Self-Em/1.png.aspx?lang=en-NZ)