Self Employed While Furloughed, The Effects Of The Coronavirus Crisis On Workers Resolution Foundation

Self employed while furloughed Indeed lately has been sought by users around us, maybe one of you. People now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the title of this post I will talk about about Self Employed While Furloughed.

- The Chancellor Has Announced Help For The Self Employed But What Does That Mean For Me This Is Money

- Coronavirus Job Retention Scheme Archives John M Taylor Co Chartered Accountants

- New Self Employment Grant And Furlough Details What Does It All Mean Shropshire Star

- Need To Know Covid 19 Unemployment Benefits For The Self Employed News At Poole College

- Explained This Is France S New Plan To Help Workers And Self Employed The Local

- Coronavirus Self Employed Small Limited Company Help

Find, Read, And Discover Self Employed While Furloughed, Such Us:

- New Self Employment Grant And Furlough Details What Does It All Mean Shropshire Star

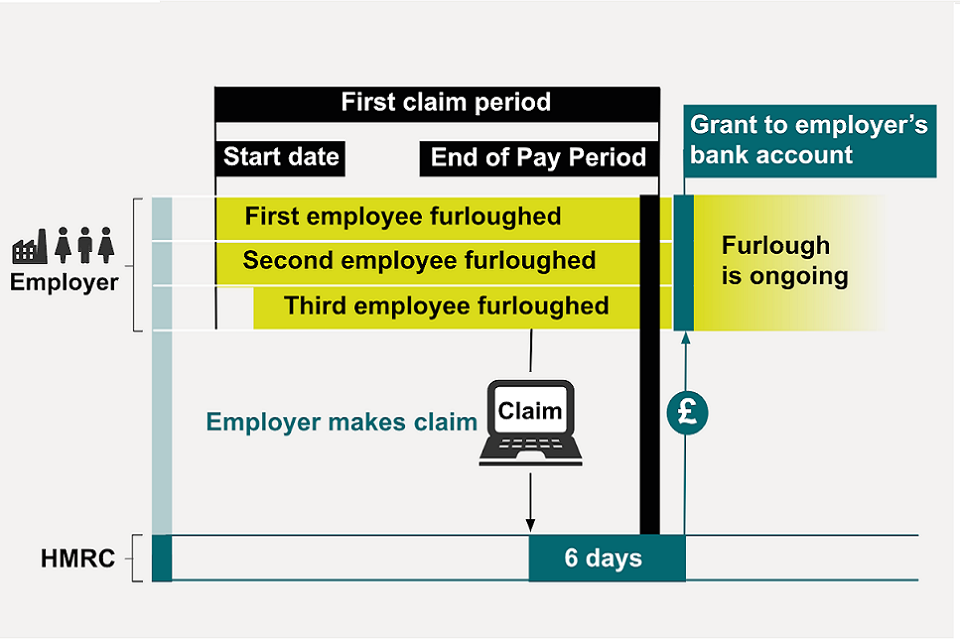

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk

- Ybkwe6sibvlw M

- Self Employed Workers Must Not Be An Afterthought Again Bectu

- Your Income And Coronavirus Covid 19 Policy In Practice

If you are searching for Furlough Rules Zero Hours Contract you've reached the right location. We ve got 101 images about furlough rules zero hours contract including images, pictures, photos, backgrounds, and more. In such webpage, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Coronavirus Support For Self Employed Extended As Chancellor Gives Timeline For Employers To Help Pay Furloughed Staff Itv News Furlough Rules Zero Hours Contract

Directors can also be furloughed.

Furlough rules zero hours contract. As of 10th may approximately 75 million jobs were furloughed in the uk as part of the coronavirus job retention scheme cjrs. The scheme rules are clear about that. The scheme introduced in response to the economic effects of the covid 19 pandemic covers 80 percent of employees wages up to 2500 a month.

If you are a self employed worker you can get a grant worth 80 per cent of your average monthly profits. The cjrs was originally meant to end in june but the chancellor has now extended it until the end of october 2020. As such they can be furloughed provided they meet the other eligibility criteria.

If you have been temporarily laid off you cannot work for your own employer. Last month it was confirmed that self employed workers whose businesses have been negatively hit by coronavirus would be able to claim a second and final grant in august. Martin lewis has given an update on what the government backed furlough scheme means for self employed workers during the coronavirus pandemic.

So if you were 60 percent self employed 40 percent employed and furloughed on the. Both employed and self employed cjrs furloughed announcements. If your employer says it is the cjrs that prevents you from working for another employer or in self employment while you are furloughed then they are wrong.

But the scheme does not not override normal employment law. The problem is that unlike the self employment scheme furloughed workers are not allowed to continue to do their normal job. These are worth up to a maximum of 2500 a month covering march april and may.

In an effort to prevent staff being laid off during the covid 19 crisis chancellor rishi sunak announced last month that the government would pay 80 of workers salaries. Self employment income support scheme. Although the government has announced it will pay a grant of up to 2500 per month to self employed people who have lost income because of coronavirus this year its scheme does not start until june meaning many will be looking for other sources of income.

While those who run limited companies may consider themselves to be self employed the purposes of this scheme consider directors to be employees of their company. What about if you are self employed.

More From Furlough Rules Zero Hours Contract

- Government Shutdown 2019 Explained

- Government Update Covid 19 Uk

- Self Employed Furlough Mortgage

- New Scheme To Replace Furlough Calculator

- Government Covid Relief Loan

Incoming Search Terms:

- Local Figures Released For Economic Support In Finchley And Golders Green Mike Freer Government Covid Relief Loan,

- Govt Extends Self Employed Support Scheme Ftadviser Com Government Covid Relief Loan,

- Help For The Self Employed Won T Save Everybody Free To Read Financial Times Government Covid Relief Loan,

- Coronavirus Self Employed Scheme Get The Details Right Accountingweb Government Covid Relief Loan,

- A Small Business Guide To Furloughing Employees And Yourself Government Covid Relief Loan,

- Need To Know Covid 19 Unemployment Benefits For The Self Employed News At Poole College Government Covid Relief Loan,