Government Bond Funds India, How To Buy And Invest In Government Bonds In India

Government bond funds india Indeed lately is being sought by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of the article I will discuss about Government Bond Funds India.

- Bond Finance Wikipedia

- Here S How You Can Gain From The Bond Rally The Economic Times

- Treasury Connect July 2019

- Best 10 Year Gilt Mutual Funds 2020 Government Bond Funds

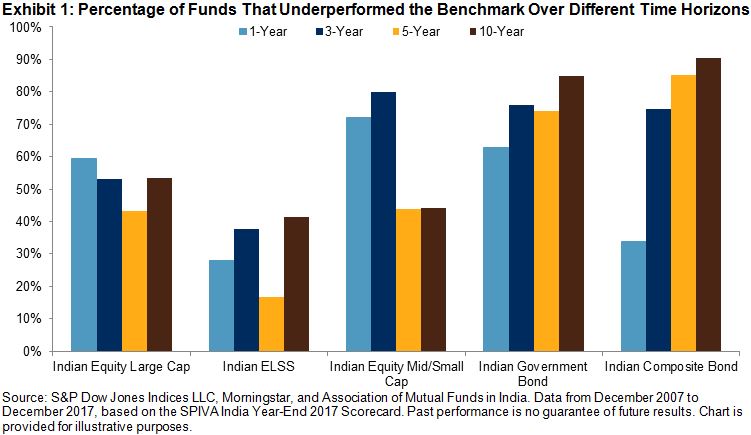

- Best Debt Funds 2020 Top 10 Performing Debt Mutual Funds

- Stick Largely To Accrual Funds Despite Softening Of 10 Yr Govt Bond Yield

Find, Read, And Discover Government Bond Funds India, Such Us:

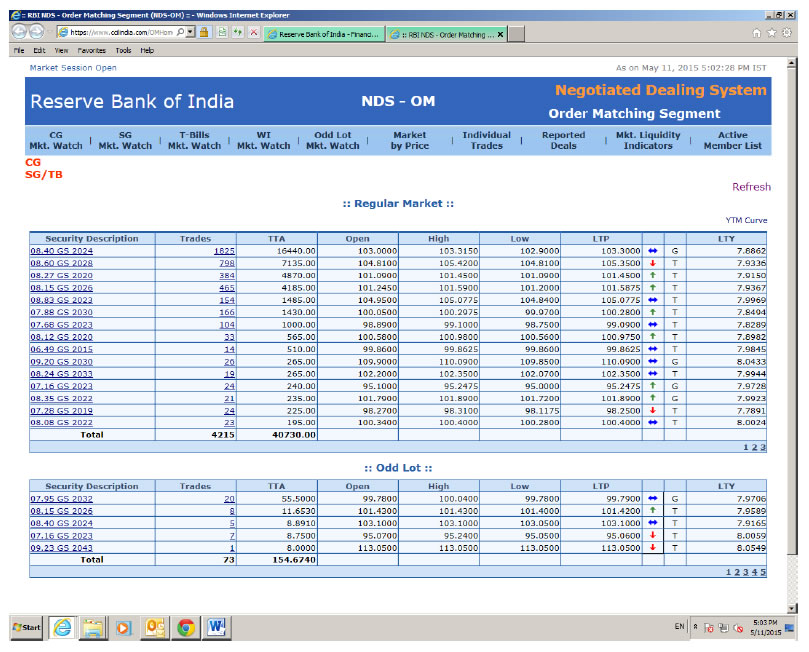

- Treasury Connect May 2019

- Kotak Gilt Investment Fund

- India Equity Research On Twitter Jefferies Rbi Net Purchases Of Government Securities And India 10 Year Government Bond Yield

- Treasury Connect July 2019

- Global Bonds Global Bond Market Looks To Modi For Greater Access To India The Economic Times

If you are searching for Government Failure Quotes you've arrived at the perfect place. We ve got 104 images about government failure quotes adding pictures, photos, photographs, backgrounds, and much more. In these page, we also have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Government bonds issued by state governments are also called state development loans sdls.

Government failure quotes. India 10y bond yield was 588 percent on thursday october 29 according to over the counter interbank yield quotes for this government bond maturity. 10 years vs 2 years bond spread is 1715 bp. This is precisely the purpose of bonds issued by the central government.

Get the latest updates on bonds issue returns government bonds infrastructure bonds non convertible debentures bondsncd bonds tax free bonds indiaissue 2020. It can be issued by both central and state governments of india. India government bond 10y generally a government bond is issued by a national government and is denominated in the countrys own currency.

Indias capital market regulator has allowed some categories of debt mutual funds to invest more in government bonds and treasury bills. Normal convexity in long term vs short term maturities. 4 nov 2020 1315 gmt0.

Central bank rate is 400 last modification in may 2020. The india credit rating is bbb according to standard poors agency. List of top 5 government bonds to invest in india.

Bonds market in india. Icici direct offers the best investment instruments called as government bonds in india having fixed maturity which help investors to invest and secure their future. Sebi has changed the design for the three funds to make room for the increase in holdings of.

Click here to know more. Government bonds indiafall under the broad category of government securities g sec and are primarily long term investment tools issued for periods ranging from 5 to 40 years. Spokespersons at sebi and the association of mutual funds of india declined an immediate comment.

Corporations need money for their day to day requirements and therefore borrow from lenders such as banks mutual funds and insurance companies. What are government bond funds. Similarly when the government of india needs money it borrows through its banker the reserve bank of india rbi.

Corporate bond funds banking psu funds and credit risk. If you spend more than you earn how do you sustain.

More From Government Failure Quotes

- Does The Furlough Scheme Cover Holiday Pay

- Government Youth Programs

- Is The Furlough Scheme Law

- What Is Furlough In Spanish

- What Is Furlough Adjustment On Payslip

Incoming Search Terms:

- Fund Invests In Mispriced Bonds What Is Furlough Adjustment On Payslip,

- Treasury Connect July 2019 What Is Furlough Adjustment On Payslip,

- Best Debt Funds India Types Of Debt Funds Tax Benefit What Is Furlough Adjustment On Payslip,

- Best Etfs In India Best Performing Etfs 2020 Top Exchange Traded Funds What Is Furlough Adjustment On Payslip,

- Bharat Bond Etf Why To Invest And Who Should Invest How To Invest In Bharat Bond Etf What Is Furlough Adjustment On Payslip,

- Treasury Connect 30th June 2019 What Is Furlough Adjustment On Payslip,