Government Home Loans For Low Income Earners, Purpose Of This Guide Pdf Free Download

Government home loans for low income earners Indeed lately is being sought by consumers around us, perhaps one of you. People now are accustomed to using the net in gadgets to see image and video information for inspiration, and according to the name of this article I will discuss about Government Home Loans For Low Income Earners.

- Providing Low Income Egyptians With Affordable And Convenient Housing

- Pdf Materialism And Indebtedness Of Low Income Consumers Evidence From South Africa S Largest Credit Granting Catalogue Retailer

- How Will Keystart Changes Help Aussies Break Into The Housing Market Your Mortgage Australia

- Gh Bank Wikipedia

- Government Benefits Usagov

- Bauchi Fg To Construct 4 000 Housing Units For Low Income Earners Daily Post Nigeria

Find, Read, And Discover Government Home Loans For Low Income Earners, Such Us:

- Cbn Approves N200bn Housing Loan For Fg S Social Housing Project Targets 900 000 Low Income Earners

- How To Buy A House If You Have A Low Income Savings Com Au

- Buy A House In 2018 With These Low Income Home Loans

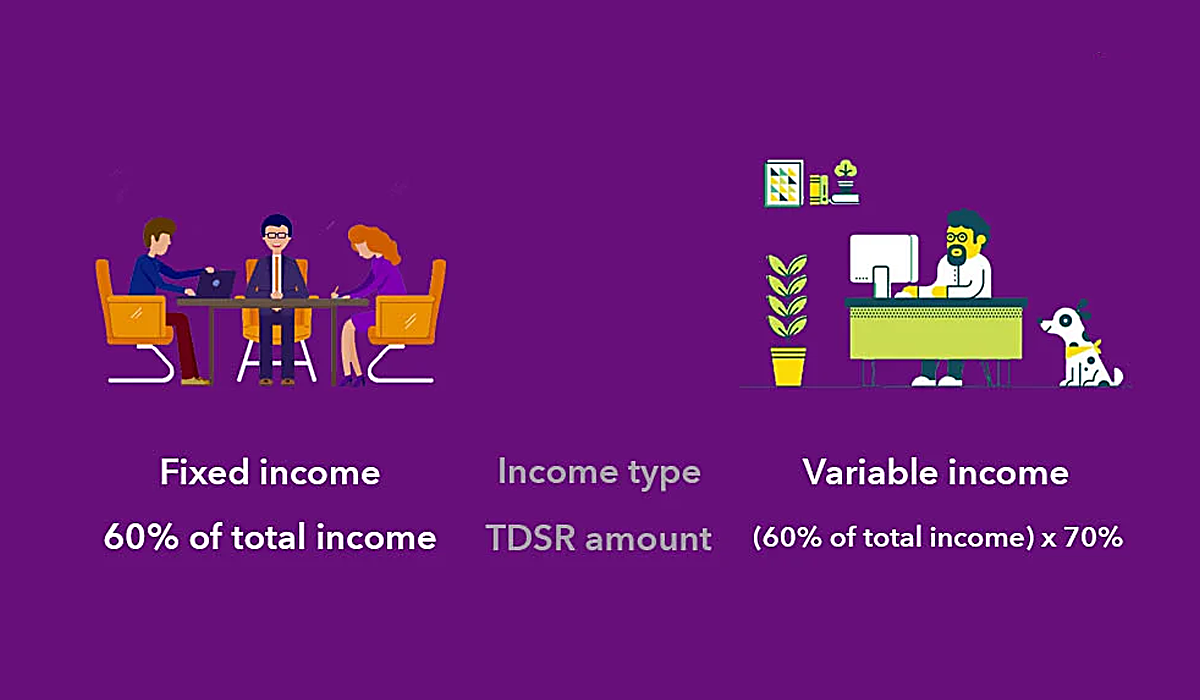

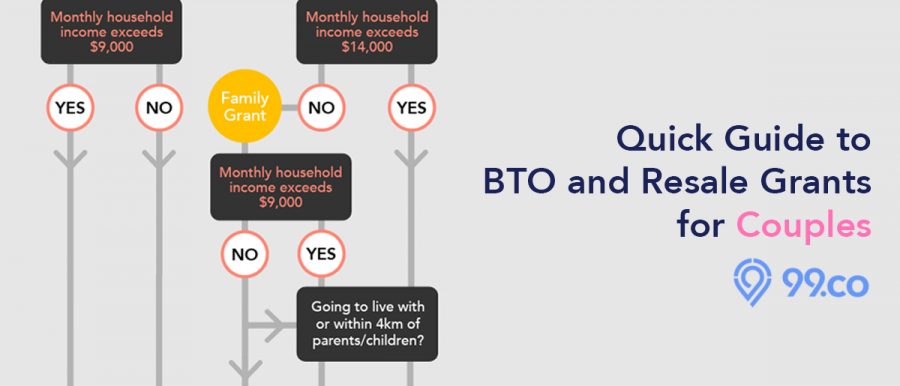

- 7 Facts About The Total Debt Servicing Ratio Tdsr Property Buyers Need To Know 99 Co

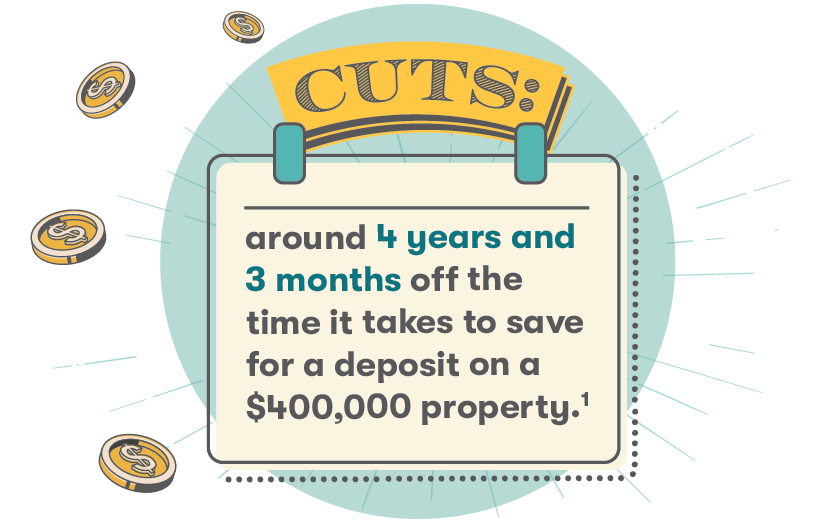

- First Home Loan Deposit Scheme 5 Deposit First Home Buyer Canstar

If you re searching for What Is Net Furlough Pay you've arrived at the ideal place. We have 104 images about what is net furlough pay adding images, pictures, photos, backgrounds, and much more. In these web page, we additionally provide number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Having a preferred 640 credit score.

What is net furlough pay. The rural housing repair loans and grants program provides loans and grants to very low income homeowners to repair improve modernize or to remove health and safety hazards in their rural dwellings. In some cases lenders can accept up to a 50 dti ratio making them a great option for low income borrowers. Loans are arranged for up to 20 years at 1 percent interest.

Its easy to feel locked out of the home loan market if youre on a low income. These new affordable houses are typically priced around r300 000 and range between 50sqm and 80sqm in size. Usda loans are catered to homebuyers with a modest income and dont require a down payment.

Low income loans australia. But there may be some alternatives you can explore particularly if your government income is supported by paid employment. Your regular living costs are another factor that lenders will use to assess your eligibility for a low income home loan.

Your lender will also look at regular government payments such as centrelink allowances plus other receipts like child support. With a stepup loan you can borrow between 800 and 3000. Managing your expenses and debt.

You have up to three years to pay back the loan with weekly fortnightly or monthly. The advantage loan the advantage loan is a boost of up to 45000 to your borrowing power for those earning up to 60000 per year 1154 per week after tax. Larger deposit low income earners can get a better chance of.

Below is a list of banks that offer home loans to lower income. The few liabilities or less outgoing cash flow you have the more of your income you can comfortably devote to home loan repayments. As many lenders have tightened their borrowing criteria over the last couple of years qualifying for a loan has become increasingly difficult.

Home loans for low income earners. A stepup loan is a low interest loan for people on lower incomes who find it hard to borrow from a bank. Despite interest rates being low your options may still be limited especially with some of the big lenders tightening their lending policies.

This trend has caused government to setup innovative products and initiatives between private developers and local banks to assist homeownership among lower income earners. The maximum debt to income ratio for an fha loan is 43. Department of agriculture also insures low income home loans provided by approved lenders up to 90 of the loan amount.

This is great because. It has a low interest rate fixed at 599 and no fees or charges. Fha loans are a type of government backed loan that is guaranteed by the federal housing administration.

More From What Is Net Furlough Pay

- Self Employed Jobs Near Me

- Government Role In Market Economy Remains

- Government Meaning In Urdu

- Self Employed Retirement Plans Irs

- Self Employed Covid Grant Apply

Incoming Search Terms:

- First Home Loan Deposit Scheme 5 Deposit First Home Buyer Canstar Self Employed Covid Grant Apply,

- Lost Millions On Twitter We Would Still Have A Home If The Perpetual Trustees Were Not Evicting Us From Our Abode Of Many Years They Used All Our Trust Funds In Their Self Employed Covid Grant Apply,

- Government Fuels Next Housing Collapse With Unstable Mortgages Rose Law Group Reporter Self Employed Covid Grant Apply,

- Free Low Income Housing Grants For Home Purchase Repair Improvement Self Employed Covid Grant Apply,

- Gh Bank Wikipedia Self Employed Covid Grant Apply,

- Home Loans For Low Income Earners Property Loans Self Employed Covid Grant Apply,