Government Revenue Formula, Econ 150 Microeconomics

Government revenue formula Indeed recently has been hunted by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the title of the article I will discuss about Government Revenue Formula.

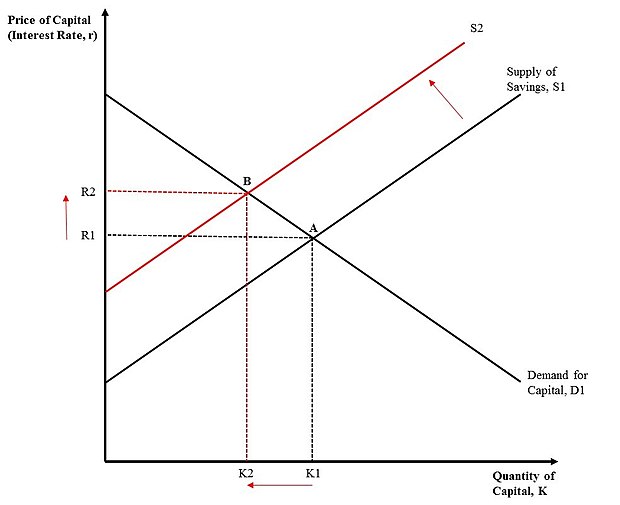

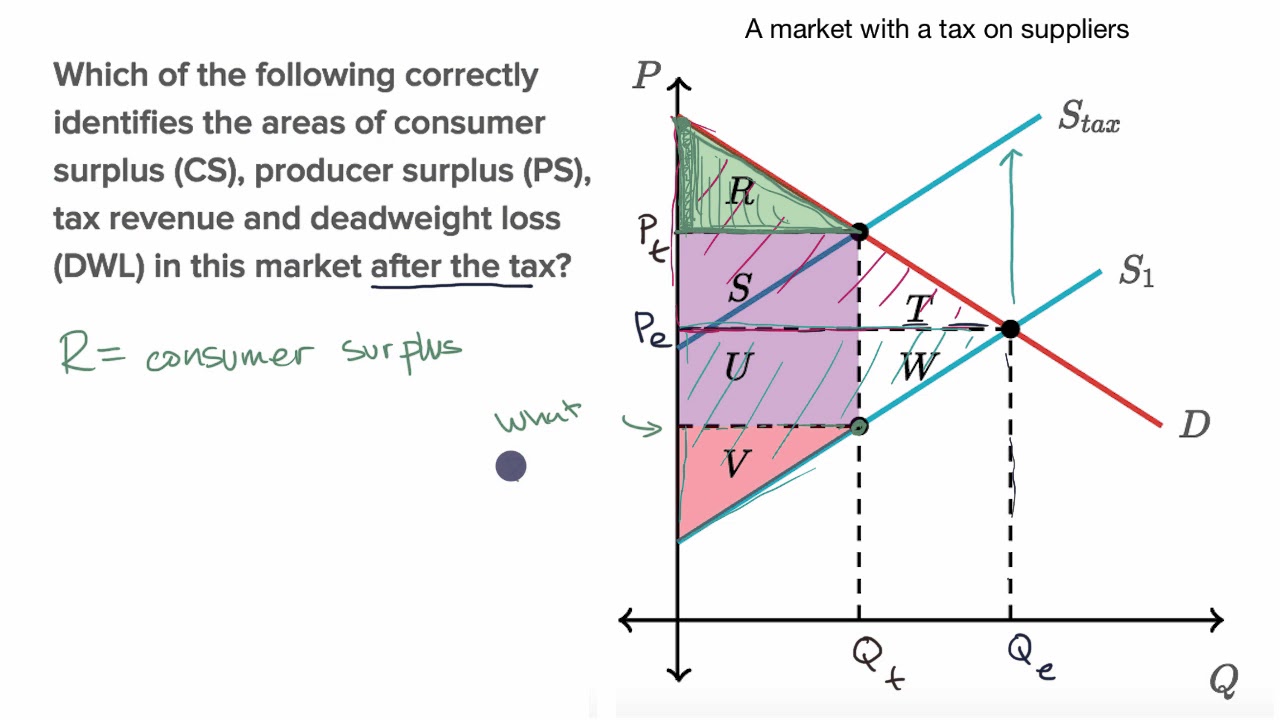

- Indirect Taxes Government Intervention Economics Tutor2u

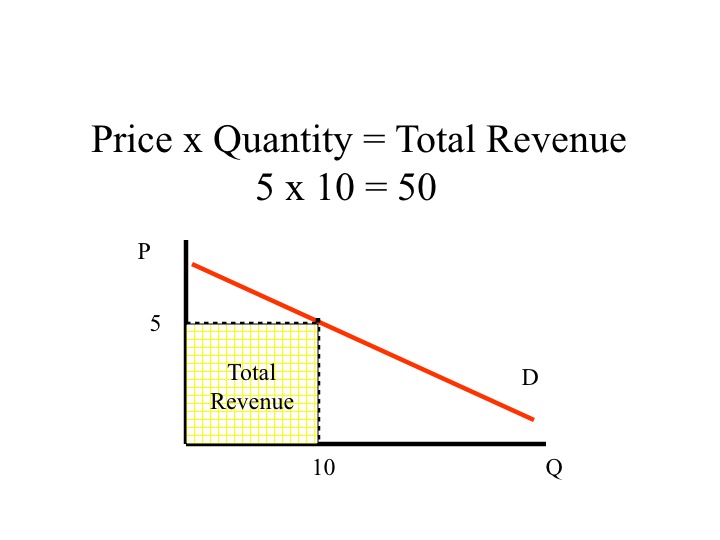

- 1 Total Revenue Price X Quantity Use This Formula To Calculate Market Total Revenue After With Government Intervention To Correct Internalize The Externality 2 When The Government Intervened Study Com

- Deadweight Loss Examples How To Calculate Deadweight Loss

- 4 7 Taxes And Subsidies Principles Of Microeconomics

- Difference Between Full Employment Budget Surplus And Budget Surplus

- 4 7 Taxes And Subsidies Principles Of Microeconomics

Find, Read, And Discover Government Revenue Formula, Such Us:

- Tax Revenue And Deadweight Loss Youtube

- Fiscal Deficit Formula Calculator Example With Excel Template

- Effects Of Taxes

- Deadweight Loss Of Taxation

- Understanding Subsidy Benefit Cost And Market Effect

If you are looking for Downloadable 2020 Self Employed Sss Contribution Table 2020 you've come to the ideal place. We have 104 images about downloadable 2020 self employed sss contribution table 2020 including images, photos, pictures, backgrounds, and much more. In these page, we also have variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

:max_bytes(150000):strip_icc()/ExxonIncojmestatement2019June-55cdf08720b24bc7b27ade3de5b6dc32.jpg)

What Is The Difference Between Revenue And Sales Downloadable 2020 Self Employed Sss Contribution Table 2020

Learning Objectives Fiscal Policy Lo1 See Why The Federal Government S Budget Depends On The Rate Of Taxation The Size Of The Gdp And Its Own Spending Ppt Download Downloadable 2020 Self Employed Sss Contribution Table 2020

In economics revenue will help know the sales of given quantity of goods and services.

Downloadable 2020 self employed sss contribution table 2020. In our previous post on the major sources of government revenue and government expenditures weve talked about how the federal government derives its revenue from different sources. Formula for distribution between the federal and state governments. A bakery sells 35 cookies packet per day at the price of 20 per pack to increase the sale of cookies owner did analysis and find that if he decreases the price of cookies by 5 his sale will increase by 5 packets of cookies he wants to.

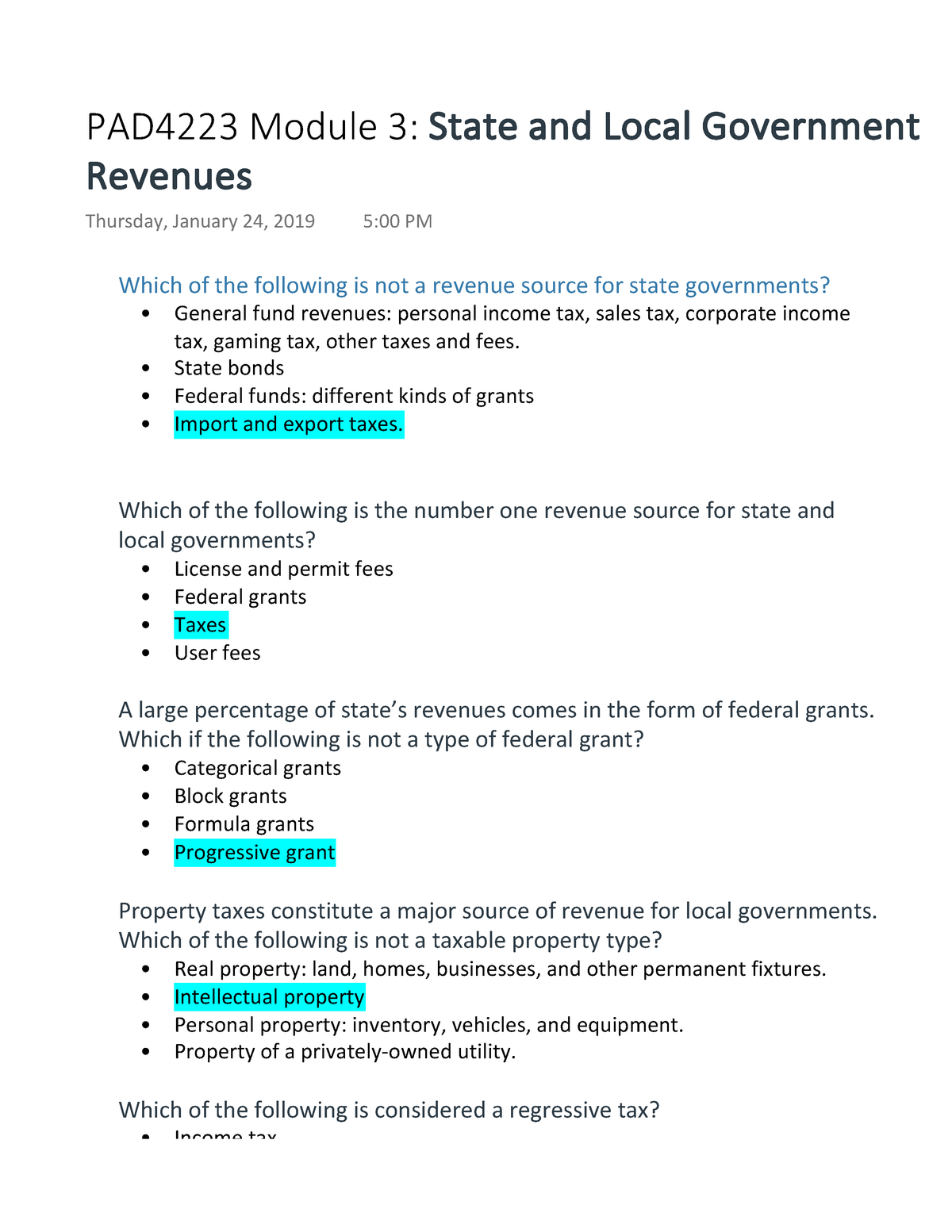

Allocations under special funds. Add each tax payment made during the legally defined tax collection period to arrive at total tax revenue. Revenue should be reported to the government periodically so that the government could know the total income of the country and collect the taxes.

The total price gained by a given source is revenue. Government revenue or national revenue is money received by a government from taxes and non tax sources to enable it to undertake government expenditures. Government revenue is the sum of.

Formula for distribution between local government councils. Revenue for year 2018 100907 revenue for year 2017 73585 revenue formula example 3. Learn how to better interpret your financial statements in this online course.

Seignorage is one of the ways a government can increase revenue by deflating the value of its. Here total sales are equal to total revenue of a company. Output for own final use payments for non market output taxes on production and imports other subsidies on production property income receivable current taxes on income and wealth etc receivable.

We can gather all of this data by starting with the revenue formula. Establishment of federation account allocation committee and functions. Revenue is the top line and net income is the bottom line.

Proportion of revenue to be paid by each state to joint local government account. 2625 10625 revenue 6000 cogs 2000 operating expenses see how it goes round circle. For instance in 2013 the state of new jersey collected a total of 8235 billion in sales and use tax revenues which was approximately 305 percent of the 27 billion the state government collected from all taxes and fees for the same period.

More From Downloadable 2020 Self Employed Sss Contribution Table 2020

- Government New Law College Indore Madhya Pradesh

- Government Administration Building Grand Cayman

- Furlough Extension Europe

- Self Employed Furlough Grant Pay Back

- Government Furlough Scheme Cut Off

Incoming Search Terms:

- Fiscal Deficit Formula Calculator Example With Excel Template Government Furlough Scheme Cut Off,

- Calculating California S Total State And Local Government Debt California Policy Center Government Furlough Scheme Cut Off,

- Review Of Revenue Allocation Formula Underway Says Rmafc Thisdaylive Government Furlough Scheme Cut Off,

- Governor Josphat Nanok S Statement On My Turkana County Government Facebook Government Furlough Scheme Cut Off,

- 15z9seysgg1dum Government Furlough Scheme Cut Off,

- Tax On Negative Externality Economics Help Government Furlough Scheme Cut Off,