Self Employed Tax Allowance For Car, Tax Deductions For The Self Employed

Self employed tax allowance for car Indeed lately is being sought by consumers around us, perhaps one of you personally. Individuals now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of this article I will talk about about Self Employed Tax Allowance For Car.

- What Expenses Can I Claim As A Self Employed Person

- Hmrc Self Employed Capital Allowances That Could Save You A Killing The Profs

- Business Car Ownership Company Or Employee

- The Low Down On Lockdown Tax Reliefs Taxscouts

- Use These Notes To Help You Fill In The Self Employment Full Pages Of Your Tax Return Pdf Free Download

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

Find, Read, And Discover Self Employed Tax Allowance For Car, Such Us:

- Solved Rates And Allowances Income Tax 2018 19 Basic Chegg Com

- Update Uk Business Mileage Rates For 2019 2020

- Tax Debate Company Car Or Car Allowance Accounts And Legal

- Tax Deductions For Rideshare Uber And Lyft Drivers Get It Back Tax Credits For People Who Work

- Self Employed Buy Or Lease A Car Which Should You Do Ratelab Ca

If you are searching for Furlough Scheme Rules For Employees you've reached the ideal location. We have 100 graphics about furlough scheme rules for employees adding pictures, pictures, photos, wallpapers, and more. In such webpage, we also provide number of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

For all other types of vehicle claim them as.

Furlough scheme rules for employees. There are two ways of working out motor expenses if youre self employed. There are various items that you can deduct from your business expenses income as running costs and expenses before you work your profits. Business owners and self employed individuals.

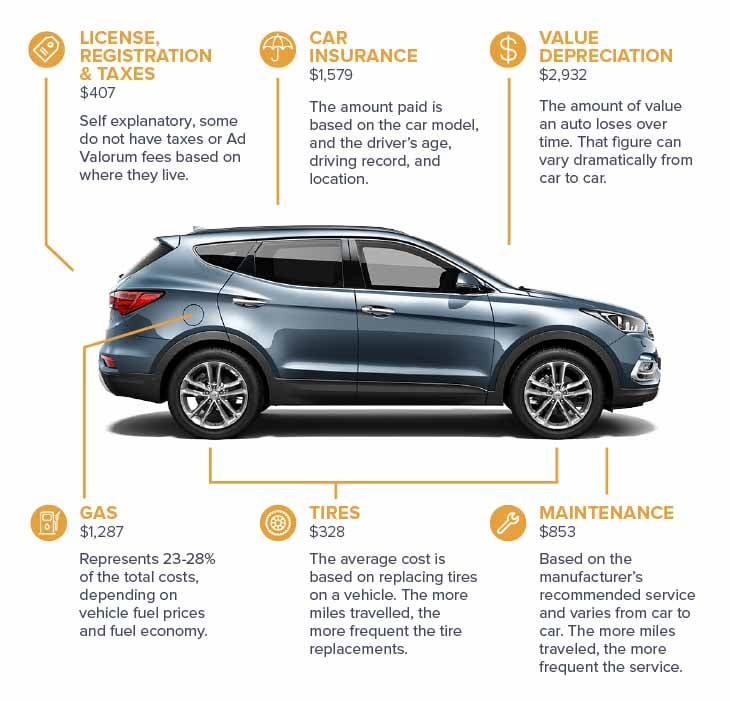

There are a few important ways that you can reduce your tax bill if youre self employed and use your car or van for business use. The deduction is based on the portion of mileage used for business. This makes year end tax filing using turbotax self employed so much easier and more accurate.

The only real difference is that vehicle excise duty road tax is only included for the first year of the lease agreement. The first year allowance means that the full cost 15000 of the low co2 car can be claimed as a capital allowance on ambers 202021 self assessment tax return. Your tax return is used to declare income you earn and also to claim any tax allowances that can be offset against your tax bill.

Business operating leasing also works in a very similar way to bch. If a taxpayer uses the car for both business and personal purposes the expenses must be split. You can use.

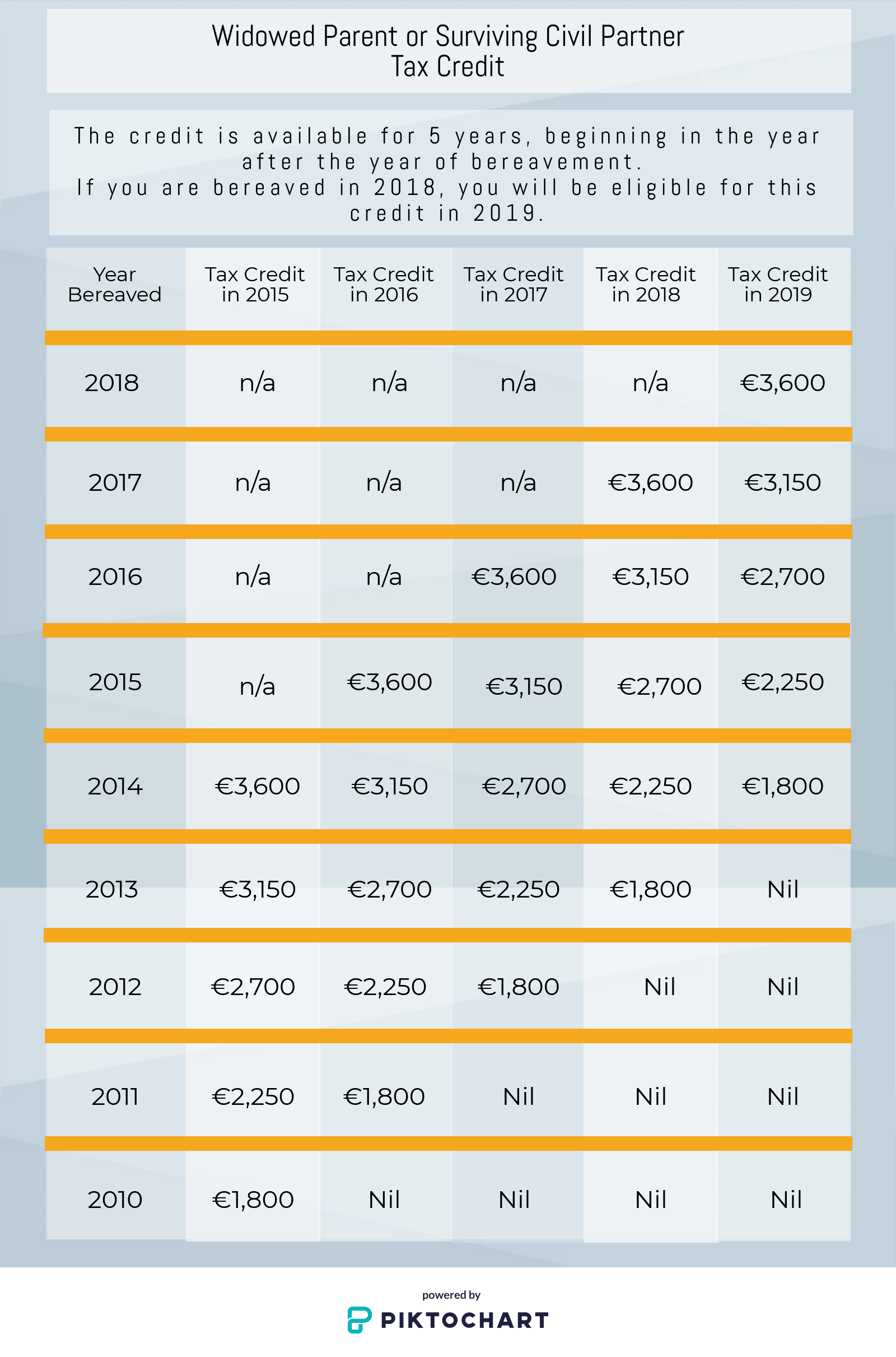

If youre self employed in ireland then youre obliged to file a self assessed tax return usually by the deadline of october 31 or by the pay and file deadline of nov 10. You are exempt from paying company car tax if you. Are the proprietor owner of your own business.

Hm revenue and customs permits self employed people to claim a fixed mileage allowance for all business mileage travelled as an alternative to apportioning total costs. Actual expenses using detailed records of business and private mileage the actual cost method. Calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle for example insurance repairs servicing fuel.

If you use cash basis accounting and buy a car for your business claim this as a capital allowance as long as youre not using simplified expenses. Its a must have for those who want to pay the least amount of taxes legally possible. A fixed rate for each mile travelled on business using hmrc fixed mileage rates the mileage method.

Do i have to pay company car tax if i am self employed. Mileage allowance or simplified expenses rules. Capital cost allowance or cca is a cost recovery method that allows you to recover the physical cost of your vehicle.

Covid 19 Coronavirus Self Employment Income Support Scheme Kyzen Sport Furlough Scheme Rules For Employees

More From Furlough Scheme Rules For Employees

- Government Id Adalah

- New Furlough Scheme November Scotland

- Furlough Scheme Rules For October

- Furlough Leave Document

- Government Providing Free Laptop Scheme 2020 In Gujarat

Incoming Search Terms:

- Hmrc Capital Allowances 2019 2020 For The Self Employed Government Providing Free Laptop Scheme 2020 In Gujarat,

- Business Car Ownership Company Or Employee Government Providing Free Laptop Scheme 2020 In Gujarat,

- Covid 19 Coronavirus Self Employment Income Support Scheme Kyzen Sport Government Providing Free Laptop Scheme 2020 In Gujarat,

- Everything You Need To Know About Claiming A Mileage Tax Deduction Taxes Us News Government Providing Free Laptop Scheme 2020 In Gujarat,

- Car Tax Allowance Blog Otomotif Keren Government Providing Free Laptop Scheme 2020 In Gujarat,

- Expenses If You Re Self Employed Car Van And Travel Expenses Gov Uk Government Providing Free Laptop Scheme 2020 In Gujarat,