Self Employed Vs Limited Company, Pdf Determinants Of Job Satisfaction For Salaried And Self Employed Professionals

Self employed vs limited company Indeed recently is being hunted by consumers around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to view image and video data for inspiration, and according to the title of this post I will discuss about Self Employed Vs Limited Company.

- How To Form A Public Limited Company 15 Steps With Pictures

- Forgottenltd On Twitter It S The Disparity With Sole Straders That S The Bitterest Pill Small Biz Owners Have Been Given An Unfair Disadvantage Vs Our Self Employed Competitors Who Continue To Trade

- Self Employment Information Leaflet Pages 1 7 Flip Pdf Download Fliphtml5

- Becoming A Ltd Driver 2019 Pages 1 7 Text Version Fliphtml5

- Should I Be Self Employed A Sole Trader Or Run A Limited Company

- Ppt Employed Versus Self Employed Status Ian M Harris Leicester City Council Powerpoint Presentation Id 3121429

Find, Read, And Discover Self Employed Vs Limited Company, Such Us:

- Coronavirus Self Employed Small Limited Company Help

- Petition Support For Self Employed Ltd Company Owners During Coronavirus Change Org

- Self Employed Or Limited Company

- Benefit Of Limited Company Vs Being Self Employed 2e Accountants

- Top 5 Accountancy Tips 2020 Youtube

If you are searching for Government Intervention Political Cartoon you've reached the ideal location. We have 100 graphics about government intervention political cartoon adding images, pictures, photos, wallpapers, and more. In these web page, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

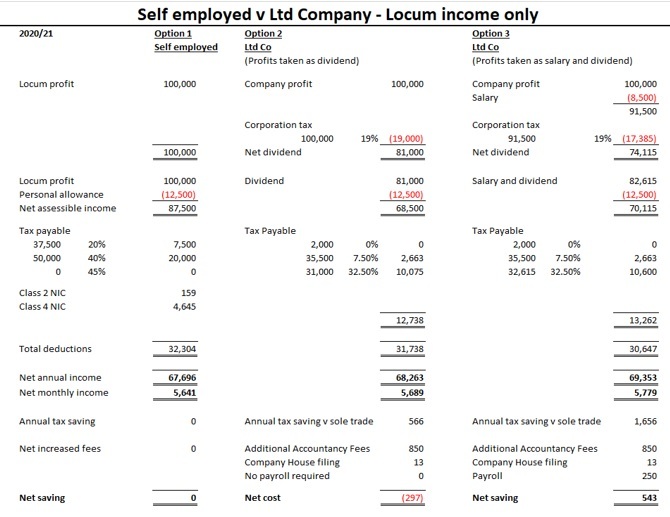

Estimate your annual profits to work out if registering your business as a limited company or as a sole trader is more tax efficient.

Government intervention political cartoon. A sole trader is a single entity with their business for tax and administration purposes whereas a limited company is a distinct entity. The biggest difference between self employment and limited company status surrounds the savings efficiencies that result in terms of tax and national insurance payments once your business profits at the 40000 mark. However as a limited company you enjoy limited liability which protects your personal assets.

As a limited company in the uk you must register for corporation tax. A sole trader is essentially a self employed person who is the sole owner of their business. As a sole trader you run your own business as a self employed person and are solely responsible for the success of it.

Treating you completely separate to that of your business. If you are self employed you complete your self assessment tax return and tell hmrc what profit you have made during that tax year and then you pay tax on this profit. The business needs to be registered with companies house directors must be appointed and an annual tax return along with a set of accounts must be filed.

To answer this question there are many different factors to consider but the one major factor that is likely to attract freelancers is the tax saving that can be made by trading through a limited company as opposed to becoming self employed. As a self employed individual you will be personally responsible for your companys debts so your personal assets could be at risk. It doesnt matter what money you have taken from the business.

The savings depend on profit and individual circumstances but this table gives an indication of the savings. As the owner youll have to declare who the shareholders and directors are although you can be both of these yourself. Sole trader vs limited company.

You are taxed on your profits. A limited company is the same in that it will pay corporation tax on its profits. You wont get a bill for this youll have to work out and report your tax bill yourself.

Use our free online limited company tax calculator to compare your take home pay as a limited company versus as a sole trader. Being a sole trader refers to the structure of your business whereas self employed refers to how you pay your taxes. Being self employed means you pay your taxes via self assessment rather than via paye.

Its the simplest business structure out there which is probably why its the most popular and you can set up as one via the govuk website.

More From Government Intervention Political Cartoon

- 2020 Calendar Tamil Nadu Government Holidays

- 3 Branches Of Us Government And Their Functions

- Self Employed Netherlands

- Government Official Letter Format In English

- Government Guidelines For Masks

Incoming Search Terms:

- Self Employed Registration By Harry James Medium Government Guidelines For Masks,

- Self Employment Wikipedia Government Guidelines For Masks,

- Http Nsfr Dk Uf 90000 99999 92226 8395cead6bd198ffb2f8ad496f22f02f Pdf Government Guidelines For Masks,

- Sole Trader Vs Limited Company Sole Trader Accounting Classes Limited Company Government Guidelines For Masks,

- Self Employed Or Limited Company Which Business Structure To Choose Government Guidelines For Masks,

- Guide To Running Your Own Business Government Guidelines For Masks,