Self Employed Vat, Self Employed Make Extra Money From The Vat Rise

Self employed vat Indeed recently has been sought by users around us, perhaps one of you. People now are accustomed to using the net in gadgets to see video and image data for inspiration, and according to the name of the post I will talk about about Self Employed Vat.

- Pacific Press Gallery Italy Protest Of Self Employed And Vat Workers

- Self Employed Fear Being Pulled Into Vat Net Business The Times

- Registering For Self Employed Taxes In Ireland Including Vat Accountsireland

- All About The Periodic Vat Declaration As A Self Employed Worker In Portugal Lisbob

- Guide To Value Added Tax In Norway Pdf Free Download

- Gordon On Twitter This How A Vat Registration Form Looks Like Registering A Self Employed Freelancer Http T Co Gsbrjmtqqt

Find, Read, And Discover Self Employed Vat, Such Us:

- Vnyor1o1ro0kam

- Ppt Employed Versus Self Employed Status Ian M Harris Leicester City Council Powerpoint Presentation Id 3121429

- Self Employed Make Extra Money From The Vat Rise

- Cld Finance Facebook

- The Deductible Expenses In The Personal Income Tax And Vat For The Self Employed Who Telework For The Covid 19 Web24 News

If you are searching for Government Accounting Meme you've arrived at the perfect place. We have 100 graphics about government accounting meme including images, pictures, photos, wallpapers, and more. In such web page, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Ppt Employed Versus Self Employed Status Ian M Harris Leicester City Council Powerpoint Presentation Id 3121429 Government Accounting Meme

Vat in portugal imposto sobre o valor agregado or iva for short is payable by all businesses with a turnover of more than 10000 on taxable goods and servicesthere are three rates of vat in portugal.

Government accounting meme. This guide aims to inform self employed professionals about vat tax filing obligations how and when to file as well as how to register for vat. 23 on taxable goods and services intermediate rate. On this page we take you through some of the various vat related issues you may have as a self employed person.

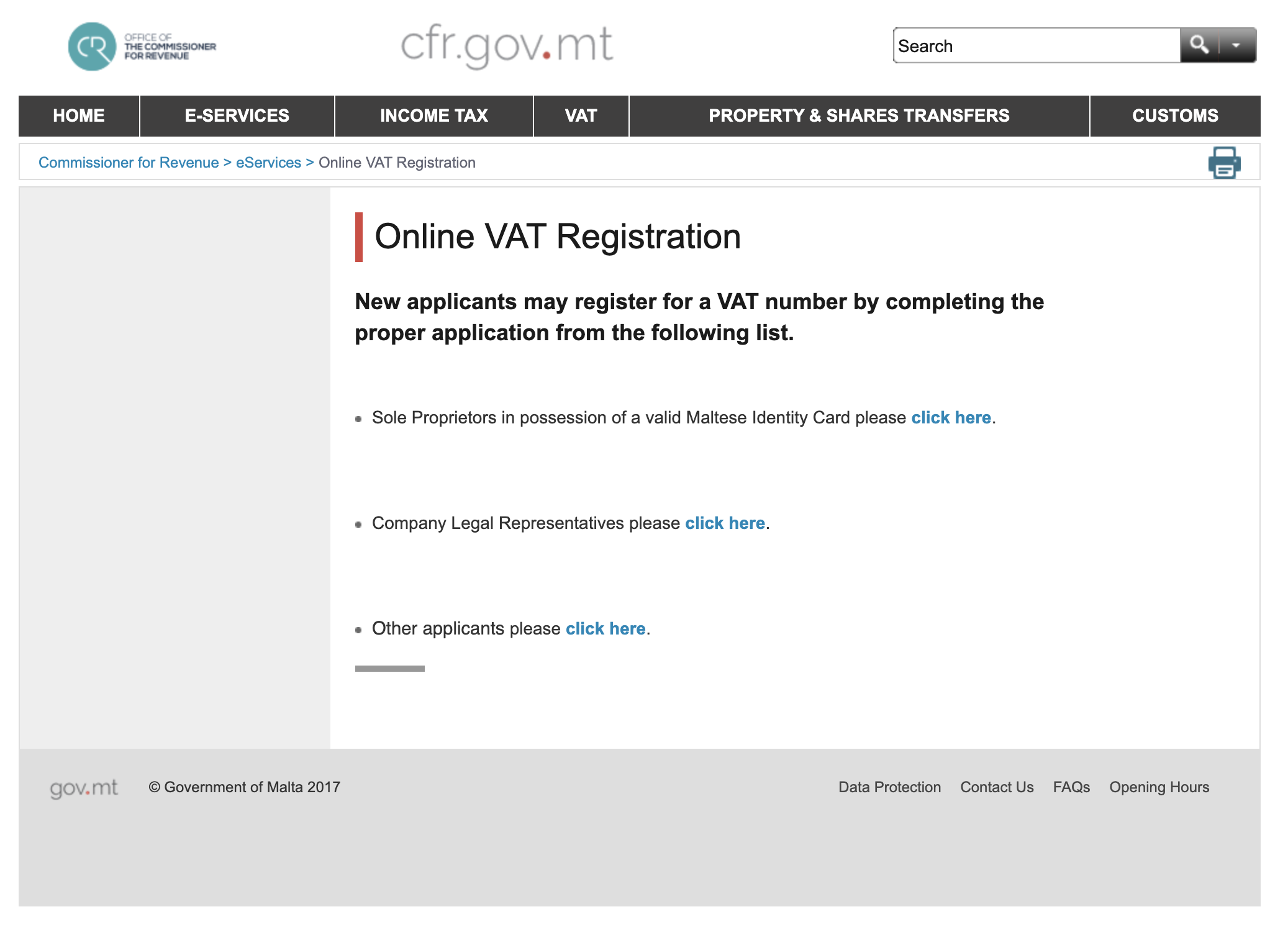

Entrepreneur for the purposes of income tax being considered an entrepreneur for the purposes of turnover tax does not mean that you will automatically be considered an entrepreneur for the purposes of income tax. Home resources guides vat advice for the self employed as you may know value added tax vat is added onto nearly every purchase anyone makes in the uk whether youre buying a bottle of wine from the supermarket or a new laptop youll be. Sole proprietors and self employed professionals now have 2 vat numbers.

A guide to vat for self employed professionals has been published by bambridge accountants. Please note we give no more than an overview here. Vat is a complex tax that attracts strict penalties.

Vat regulations differ for those who are self employed. Advice on vat for self employed drivers being a self employed owner driver gives you the option to run your own business. Not all self employed businesses need to be registered for vat.

Let us explain them in some depth. 6 on essential necessities including. If your self employed business profits exceed the vat threshold youll have to register for vat and regularly make a vat return.

Hmrcs making tax digital plans involve getting small businesses and the self employed to complete digital tax records and returns with the eventual aim of going completely paperless. Universal social charge prsi and vat. Everyone is liable to pay the universal social charge usc if their gross income is over 13000 in a year.

The information can be used by all tax filers. Vat in portugal for self employed people. An extra charge of 3 applies to any self employed income over 100000 regardless of age.

Next all vat registered businesses will need to comply with making tax digital for vat from april 2022. This means that self employed people pay a total of 11 usc on any income over 100000. Vat can strike fear into the heart of the self employed.

13 on food and drink reduced rate. A vat identification number btw id and a vat tax number. Get a greater understanding of vat and find out if you should register or not.

More From Government Accounting Meme

- Sss Payment Slip Form For Self Employed

- Government Shutdown 2020 Coronavirus

- Government Institutions

- Self Employed Covid

- Government Animal Hospital Near Me

Incoming Search Terms:

- Vnyor1o1ro0kam Government Animal Hospital Near Me,

- Do I Have To Pay Vat If I Am Self Employed Low Incomes Tax Reform Group Government Animal Hospital Near Me,

- Entry 76 By Itopup777 For Design A Professional And Impactful Double Side Business Card Freelancer Government Animal Hospital Near Me,

- Delay Paying Your Vat Again Covid Business Support Youtube Government Animal Hospital Near Me,

- Pdf The Best Small Business Accounts Book Yellow Version For A Non Vat Registered Small Business Download Online Ongis Simasne Book 1 Government Animal Hospital Near Me,

- The Deductible Expenses In The Personal Income Tax And Vat For The Self Employed Who Telework For The Covid 19 Web24 News Government Animal Hospital Near Me,