Self Employed Income Tax, The Impact Of The Recent Social Security And Income Tax Reform On Business Stakeholders Karageorgiou Associates

Self employed income tax Indeed lately is being hunted by consumers around us, perhaps one of you. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of the article I will talk about about Self Employed Income Tax.

- Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

- Preparing Your Small Business And Self Employed Tax Return With Ufile Tax Software

- Pdf Using Public Information To Estimate Self Employment Earnings Of Informal Suppliers

- Income Tax For Self Employed Professionals Infographic Cloudcfo

- Income Tax Forms Income Tax Forms For Self Employed

- Self Employment Income Estimator Tool Beyond The Basics

Find, Read, And Discover Self Employed Income Tax, Such Us:

- The Impact Of The Recent Social Security And Income Tax Reform On Business Stakeholders Karageorgiou Associates

- 1

- Pesonal Income Taxes

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctw7rwjhqvgpuzhoimbk04bp1 H 6gjv1nh Btkch8o6odh0gpz Usqp Cau

- Filing Self Employed Side Hustle Tax Returns On My Ir Sam Harith The Comic Accountant

If you are searching for State Government Jobs List you've reached the ideal location. We ve got 104 graphics about state government jobs list including images, pictures, photos, backgrounds, and much more. In such page, we additionally have variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

However self employed people pay income tax differently and they may pay a different amount.

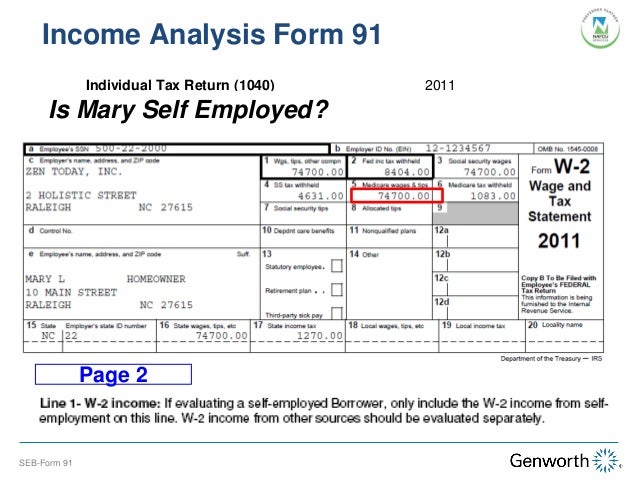

State government jobs list. You can use our 2020 21 income tax calculator to find out how much youll pay. Income for which you received a w 2which would mean you are an employeecannot be calculated as self employment income. Notification to file income tax return.

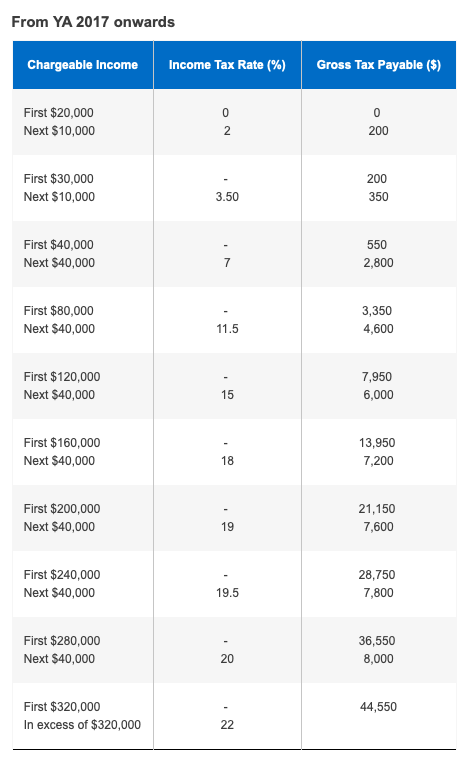

The same goes for income received from an activity that fits the narrow irs definition of a hobby. Calculating self employment income when you work for someone else you get a w 2 form from your employer at the end of the year telling you exactly how much money you made. The business income is part of the total personal income which is taxed at individual income tax rates.

What is the self employed income tax rate. Unless your self employment involves dealing and brokering investment. It is similar to the social security and medicare taxes withheld from the pay of most wage earners.

What is not considered self employment income. The full 20 is only available to self employed taxpayers whose incomes fall below certain thresholds however. Self employed people must keep track of their own income estimate how much tax they owe and in most cases makes estimated tax payments throughout the year.

When it comes to paying income tax there arent any differences in the tax rates you pay compared to employees. Write to hmrc at the address shown on the most recent letter they have sent. You must file an income tax return if you receive a letter form or an sms from iras informing you to do so.

Some 730000 were expected to file a tax return last year according to taxback. You are a self employed person when you earn a living by carrying on a trade business profession or vocation. Self employed individuals generally must pay self employment tax se tax as well as income tax.

What are the self employed income tax rates for 2020 21. Self employed persons sole proprietors and partners must file their annual tax return if they received a notification form iras to file. Call hmrc if youre self employed and have an income tax enquiry or need to report changes to your personal details.

The number of people who now file a self assessed tax return has shot up by 112000 in the last five years. For employees income tax is generally deducted at source that is its taken out of pay packets before salaries are paid to the worker. In general anytime the wording self employment tax.

Se tax is a social security and medicare tax primarily for individuals who work for themselves. In the 2020 21 tax year self employed and employees pay. Self employed required to file tax.

More From State Government Jobs List

- Furlough Scheme Rules After June

- Cayman Islands Government Administration Building

- Furlough Extension End Of June

- What Is Furlough Currently

- What Is Furlough Canada

Incoming Search Terms:

- 5 Tips For Self Employed Tax Preparation With A Spreadsheet What Is Furlough Canada,

- Are You Self Employed Don T Miss Out On Your Income Tax Or Cpf Contribution What Is Furlough Canada,

- Filing Self Employed Side Hustle Tax Returns On My Ir Sam Harith The Comic Accountant What Is Furlough Canada,

- Uk Self Employed Income Tax A Simple Guide What Is Furlough Canada,

- Calculating Your Tax With Self Employment Tax Calculator Is Safe Providing Details Is Just What People Need To Do Every Self Employment Employment Income Tax What Is Furlough Canada,

- Gig Workers Self Employed Disregarded Llc What Is Furlough Canada,

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)